Introduction:

In a competitive real estate market like Los Angeles, you might hear the term “all-cash offer” thrown around as a big advantage for both buyers and sellers. But what exactly is a cash offer on a house, and why does it matter? In simple terms, a cash offer means the buyer is purchasing the property without a mortgage loan – they have the funds readily available to pay the full price. This can make a cash home sale move much faster and with fewer hurdles than a traditional financed deal. Sellers often find a cash offer for their house appealing because it eliminates worries about loan approvals or appraisals falling through at the last minute. Buyers who can make a cash offer on a home also enjoy a leg up in negotiations, since their bid comes with more certainty and can close quickly.

Cash offers in real estate have become more common than you might think. Nationwide, nearly 4 in 10 home sales are now all-cash transactions, the highest share in about a decade. High home prices and rising interest rates have motivated more buyers to use cash, whether from savings, investments, or profits from a previous home sale, to avoid costly loans. Los Angeles in particular sees its fair share of cash buyers in real estate – from investors looking for properties to flip or rent, to well-off individuals downsizing or relocating who prefer the speed of a cash purchase. If you’re a homeowner in Southern California, it’s worth understanding the ins and outs of cash offers. This guide will explain what a cash offer means in real estate, how the process works, who these cash buyers are, and the pros and cons for both sellers and buyers. We’ll also cover some frequently asked questions (FAQs) and end with tips on next steps if you’re considering selling your Los Angeles home for cash. Let’s dive in!

What Exactly Is a Cash Offer on a House?

A cash offer in real estate means the buyer is offering to purchase the property outright, without financing the purchase with a mortgage loan. In other words, the buyer has enough liquid funds (cash in the bank or other readily available money) to pay the full purchase price at closing. Instead of relying on a lender to fund the transaction, the buyer will typically pay via a cashier’s check or wire transfer for the entire amount. This is what people mean by an “all-cash offer” or a “cash sale” for a house.

To clarify, a cash offer does not literally mean the buyer shows up with a suitcase full of dollar bills. It simply means no third-party lender is involved. The result is a sale that can happen much faster and with greater certainty. There’s no need for mortgage underwriting, no loan contingency, and often no appraisal requirement (since appraisals are usually required by lenders). For the seller, a cash house offer brings peace of mind that the deal won’t be delayed or derailed by financing issues. For the buyer, it means owning the home free and clear from day one – no monthly mortgage payments or interest.

How common are cash offers? More common than you might expect. As mentioned, recent data shows roughly 38.9% of U.S. home sales in 2024 were all-cash deals – that’s almost 1 in 3 homes being sold without a mortgage. In high-demand California markets like Los Angeles, many sellers receive cash offers on their homes, especially for properties that attract investors or luxury buyers. Cash sales tend to spike when interest rates are high (making loans more expensive) or when competition for homes is fierce. If you’re selling a property that needs work or you’re in a hurry to close, seeking a cash offer for your house can be a smart strategy. On the flip side, if you’re buying and have the means, making a cash offer on a house could help your bid stand out among multiple offers.

One important note: a cash offer might save time and eliminate mortgage-related fees, but it doesn’t mean there are zero transaction costs. Closing costs still apply in a cash real estate sale – things like title insurance, escrow fees, transfer taxes, and so on. The good news is these costs are generally lower without a lender involved (for example, no loan origination fees or mortgage insurance). Just keep in mind that even in an all-cash real estate transaction, both buyer and seller will have a few standard closing expenses to cover.

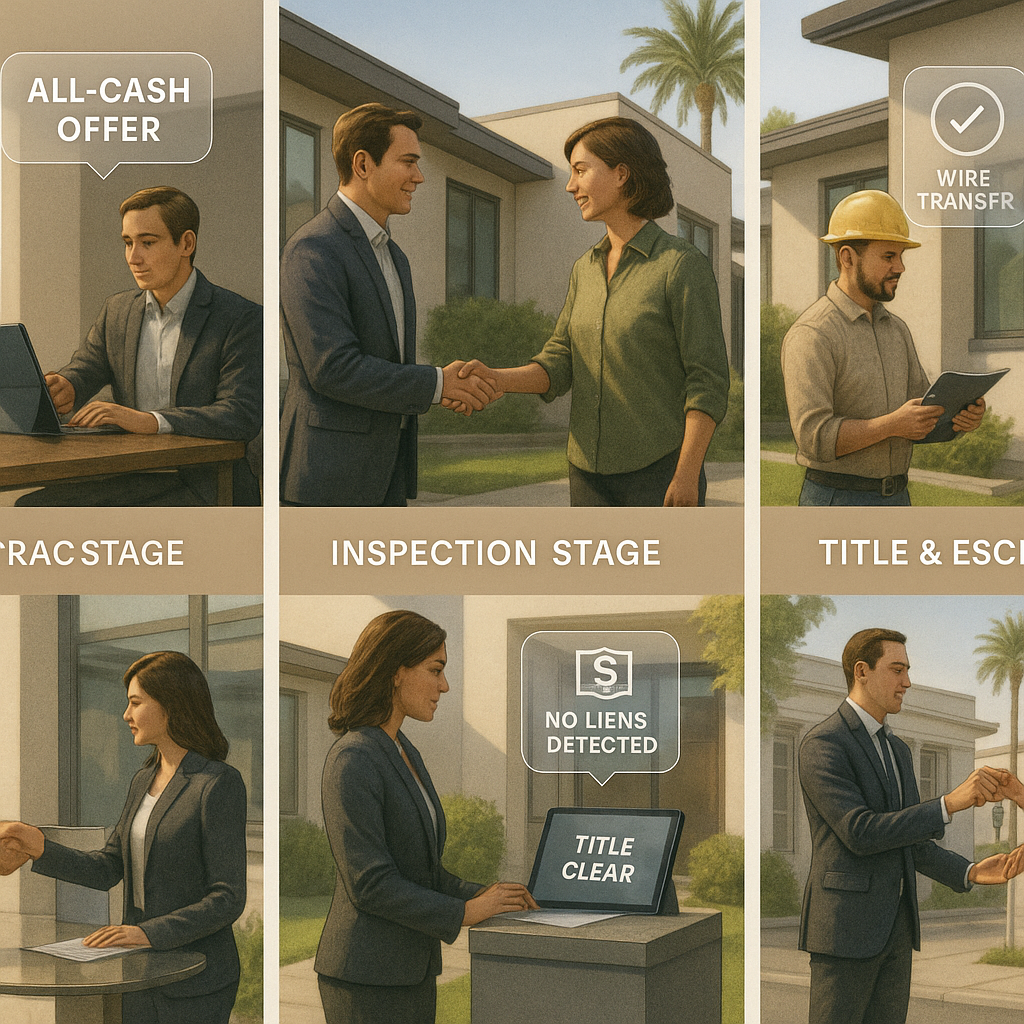

How Does a Cash Offer on a House Work? (Step-by-Step)

Example: The typical steps of a cash home sale, from requesting an offer to closing and payment, can happen much faster than a financed sale.

If you’re wondering how a cash offer works, the process is actually more straightforward than a financed sale. Without a bank’s involvement, there are fewer hoops to jump through. Here’s an overview of the cash offer on house process from start to finish:

- Buyer Makes an All-Cash Offer: The process begins when a buyer submits an offer on the property stating they will pay in cash (no financing). The offer will include the proposed purchase price and any other terms, such as an earnest money deposit, desired closing date, or contingencies (like an inspection contingency). From the seller’s perspective, a cash offer is attractive because there’s no risk of the buyer’s loan being denied – one major uncertainty is off the table.

- Offer Acceptance & Contract: If the seller is happy with the price and terms, they’ll accept the offer. Both parties then sign a purchase agreement (the contract of sale), which officially locks in the deal’s terms. The buyer will usually put down an earnest money deposit at this stage to show they’re serious. With a cash offer, the earnest money might be a sizable amount, but it’s often held in an escrow account until closing. Once the contract is signed, the home is effectively “under contract” as a cash sale.

- Due Diligence and Inspections: Just because there’s no lender doesn’t mean you skip all the normal precautions. Most cash buyers for real estate will still perform home inspections or other due diligence. The buyer will hire a professional inspector to check the property’s condition. If issues come up, the buyer might negotiate repairs or request a price reduction, even in an as-is cash offer on the house (an “as-is” cash offer means the buyer is willing to take the home in its current condition, but major problems can still prompt discussion). This step ensures the buyer isn’t buying a money pit, and it protects both sides from surprises.

- Title Search and Escrow: Meanwhile, a title company or closing attorney will conduct a title search to make sure the property’s title is clear – no liens, outstanding debts, or ownership disputes. Even cash sales go through this crucial step to ensure the seller can convey clear title. The buyer will also arrange to place the purchase funds into escrow. In a cash deal, the escrow process is simpler: the cash is held by the escrow or title company until all conditions of the sale are met. This neutral third party (escrow agent) safeguards the money and documents until closing day.

- Closing the Deal: Closing on a cash real estate purchase is typically much faster and easier than closing with a loan. Because there’s no lender’s underwriting or lengthy paperwork, a cash offer house sale can close in a matter of days once inspections and title checks are done. At the closing (often at a title company office), the buyer signs the final documents and transfers the funds for the purchase price (the escrow company wires the money or provides a certified check to the seller). The seller, in turn, signs over the deed and ownership of the property to the buyer. With everything signed and funds disbursed, the sale is complete.

- Transfer of Ownership: After closing, the deed gets recorded at the county recorder’s office, making the buyer the new official owner. The seller hands over the keys, and the cash home sale is finalized. From start to finish, this whole cash offer process can take as little as a week or two, depending on how quickly inspections and title work are completed. In contrast, a mortgage-financed sale often takes 30-60 days (or more) to close because of all the lender requirements. The speed of cash is a huge benefit for both parties looking for a quick house sale.

Keep in mind: Even though it’s a cash deal, the buyer and seller can still negotiate contingencies if they choose. For example, a cash buyer might include an inspection contingency, or a seller might insist on a proof of funds contingency (requiring the buyer to show they have the cash). But overall, there are usually fewer contingencies with cash since the financing contingency is out of the picture entirely.

Who Are These Cash Buyers in Real Estate?

When we talk about cash buyers for houses, it can refer to a few different types of people or companies. Understanding who makes cash offers on homes will give you a clearer picture of why someone might be able to buy without a loan:

- Everyday Homebuyers with Liquidity: First, there are ordinary homebuyers (individuals or families) who simply have the funds available. How? Often it’s someone who recently sold their previous home and netted a large profit, which they’re now using to buy their next house outright. For example, a long-time homeowner in Los Angeles might sell their home and walk away with significant equity, then turn around and buy their next house with cash to avoid having a mortgage. Others might have substantial savings or even inherit money that allows them to be a cash buyer. In competitive markets, some move-up buyers will temporarily tap investments or get help from family to present a cash offer, knowing they can be paid back once they sell their current home.

- Real Estate Investors and Flippers: A big portion of cash offers come from real estate investors. These include local “we buy houses for cash” companies, house flippers, and landlord investors. Their business model is to purchase properties quickly, often as-is for cash, then renovate and resell at a profit (a flip), or hold the property as a rental. Because they intend to make money on the deal, investors are usually cash buyers – they often have private funding, lines of credit, or capital on hand to close without a bank. In Los Angeles, you’ve probably seen signs or ads like “Buy house cash offer – any condition.” Those are targeting homeowners who need a fast sale. Cash offer companies make it easy by handling all the paperwork and usually closing in a matter of days. The trade-off is they typically offer below market value (they need a margin for repairs and profit). We’ll discuss that more in the pros and cons.

- iBuyers and Tech Companies: In recent years, tech-driven real estate companies known as iBuyers (Instant Buyers) have also joined the cash offer scene. Companies like Opendoor, Offerpad, or HomeLight’s Simple Sale platform will present instant cash offers on homes through an online process. These companies use algorithms to price your home and can often make an offer within 24-48 hours after you submit information. They, too, are investors – they might charge a service fee or adjust the offer after an inspection. The key appeal is speed and convenience: no showings, no waiting. In a city like Los Angeles, iBuyers may be selective (often preferring newer homes in certain price ranges), but they’re an option for sellers who want a quick cash offer on your home with minimal hassle.

- Buy-and-Hold Cash Buyers: Another category is buy-and-hold investors, such as individuals or companies that buy properties with cash to rent them out long-term or to hold as an investment (perhaps anticipating future appreciation). These buyers also value a swift, certain transaction and often target markets like Southern California where rental demand is strong. They might pay closer to market price if they believe the property will be a good long-term asset, especially if they’re competing with other buyers.

So, cash buyers in real estate range from regular people to large companies. The common thread is that they have readily available funds and can skip the mortgage process entirely. If you’re a seller entertaining a cash offer, it’s wise to find out what type of buyer you’re dealing with. Is it an owner-occupier excited to live in your home, or an investor looking for their next project? Their motivations might differ, which can influence the experience (for instance, an investor might be more likely to buy “as-is” and close super fast, whereas an ordinary buyer might still take time for inspections or even negotiations on price).

Tricia Watts, a Los Angeles real estate expert and founder of MaxNet Homes, has worked with all types of cash buyers. She notes that transparency and credibility are key: “Whether it’s an individual or a company making a cash offer for your property, you want to ensure they’re reputable and truly have the funds. In my experience, legitimate cash buyers should be willing to provide proof of funds and operate on your timeline with zero pressure.” In fact, in hot markets like L.A., Tricia has seen that all-cash offers can sometimes be just as high (or nearly as high) as financed offers. Why? Because savvy cash buyers know a strong price will seal the deal, and they’re saving in other ways by not paying loan interest. If I had the choice as a seller, I’d often lean toward the cash offer because there’s less red tape and risk involved, she says, echoing a sentiment shared by many seasoned real estate agents.

Why Do Sellers Like All-Cash Offers? (Pros and Cons for Home Sellers)

From a home seller’s perspective, a cash offer can be very enticing. The phrase “sell your home for cash” conjures images of a quick, stress-free transaction – and often that’s true. Here are the main benefits of accepting a cash offer when you’re selling your house:

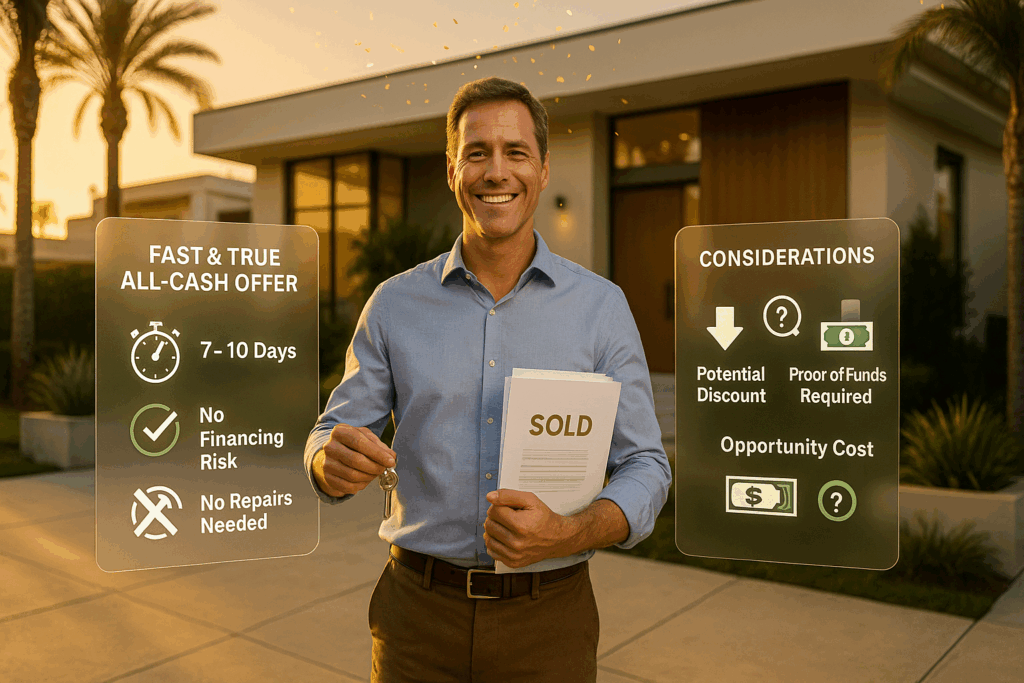

- Faster, More Convenient Sale: A cash sale can close in a fraction of the time of a traditional sale. You might go from “get a cash offer on my house” to sold in as little as 7-10 days, whereas a mortgage-involved sale might take over two months. If you need to sell your house fast – perhaps due to a job relocation, financial constraints, or you’ve already purchased another home – a cash buyer can be a lifesaver. Skipping lender approval means cutting out a huge source of delay. No waiting for the bank’s appraisal scheduling, underwriting, or loan docs. Cash offers on homes streamline the process to just the essentials: agreement, inspection, title work, and closing.

- Less Risk of Deal Falling Through: One of the biggest advantages of an all-cash offer on a house is certainty. When a buyer has to get a loan, there are multiple points where things can go wrong – maybe the lender’s appraisal comes in low, or the buyer’s financing falls apart due to a credit issue or job change. With a cash buyer, those risks virtually disappear. There’s no lender to impose last-minute conditions. Sellers often say a cash offer gives them greater peace of mind that the sale will actually go through. It’s not 100% guaranteed (the buyer could still back out for other reasons, unless they waived all contingencies), but it eliminates the number one deal killer: financing problems.

- Fewer Contingencies (Often As-Is Sales): Cash buyers tend to purchase homes “as-is”, meaning the seller isn’t asked to make extensive repairs or upgrades. Of course, this isn’t universal – a private cash buyer might still negotiate if an inspection reveals issues – but in many cash deals (especially investor deals), the buyer is willing to take the home in its current condition. As a seller, not having to fix that aging roof or update the electrical before selling is a relief. Additionally, cash offers might come with fewer contract contingencies overall. For example, a cash offer for your home might waive the appraisal contingency and sometimes even the inspection contingency if the buyer is really eager or the house is being sold as-is at a lower price. Fewer contingencies = fewer ways the deal can fall apart.

- Flexibility and Simplified Paperwork: With no lender involved, the paperwork at closing is a lot thinner. There are no loan documents for the buyer to sign, and often the escrow can be scheduled at a time that suits both parties more easily. Cash home offers often let you (the seller) propose a convenient closing date. Need an extra month to move out? Many cash buyers, especially the companies, will accommodate that. Or if you want to close ASAP, they can do that too. This flexibility can make the whole selling experience more comfortable and in your control.

That said, it’s important to weigh the potential downsides of cash offers for sellers as well:

- Price Could Be Lower: Frequently, a cash offer for a house might come in a bit below the market value or below what a well-funded financed buyer might pay. Buyers know that cash is a desirable feature, and some expect a discount in return for providing a quick, guaranteed sale. This is especially true for investor buyers – as noted earlier, a house flipper or “we buy houses” company typically offers between 50% to 70% of the home’s full market value (after accounting for repairs). Even regular buyers might feel that since they’re offering convenience and speed, they can justify a slightly lower price. However, this is not a universal rule; in hot markets (like many Los Angeles neighborhoods) or for highly sought-after properties, cash buyers may still pay full market price to beat out the competition. As a seller, consider your priorities: is the absolute top dollar more important, or is a guaranteed quick sale worth a small discount? Sometimes, financed offers may be higher, but they come with more uncertainty.

- Proof of Funds Needed: When you receive a cash offer, you’ll want to be sure the buyer truly has the money. Unlike a pre-approved loan (where a lender letter shows borrowing capacity), a cash buyer should provide a proof of funds document. This could be a bank statement or a letter from their bank verifying they have sufficient funds for the purchase and closing costs. If a buyer is hesitant to show this, that’s a red flag. Reputable cash buyers understand this concern and are prepared to prove they have the cash ready. We’ll talk more about verifying cash buyers in a moment.

- Opportunity Cost: If you’re selling to an investor at a lower price, you might wonder if you could have gotten more by listing traditionally. That’s a valid question. Not every situation calls for a cash sale. If your home is in great condition and you aren’t under time pressure, you might fetch a higher price by listing on the open market to attract both financed and cash buyers. On the other hand, if speed and certainty matter more right now, the cash offer might be the smarter choice even if the dollar amount is a bit less. Some sellers will even negotiate: “I’ll take your cash offer if you can do X (like close in 10 days and let me stay an extra week), but I need $Y price.” Depending on the buyer, they might agree, since they know you value the quick sale.

Protecting Yourself: To ensure you’re making a sound decision when you get a cash offer on your house, do a bit of due diligence on the buyer and the offer. Here are some quick tips:

- Request Proof of Funds: Always ask for a proof-of-funds letter or bank statement from the buyer. This document should clearly show that the buyer has access to the full purchase amount (and additional funds for any closing costs). Serious cash buyers expect this request. Tricia Watts advises, “If someone offers to buy your home for cash, they should have no issue providing a simple letter from their bank. It’s about protecting you as a seller – you need to know they can really close the deal.”

- Verify the Details: Check that the proof of funds is recent and that the name on the account matches the buyer (or their LLC if they’re using one). If the buyer claims the money is coming from, say, the sale of another property or an investment account, it’s okay to ask for a bit of explanation. Legitimate buyers will understand you’re being careful.

- Consult a Professional: If you’re unsure about whether the cash offer for your property is fair, consider consulting a local real estate agent or appraiser for a quick price opinion. Even if you don’t list the home traditionally, getting a professional’s view on what your home is worth can help you evaluate if the cash offer is reasonable or too low. This is especially useful if you have multiple offers and one is cash – an agent can help compare a higher financed offer with a slightly lower cash offer in terms of net proceeds and likelihood to close.

- Trust Your Instincts: Finally, go with your gut. If something feels “off” about the buyer – maybe they’re pressuring you to decide immediately or the offer seems too good to be true – take a step back. A trustworthy cash buyer (whether an individual or company) will give you time to consider and won’t use high-pressure tactics. You deserve a fair, transparent deal. As Tricia emphasizes, selling a home is a big decision, and the buyer should respect that. If they don’t, you might want to explore other options or buyers.

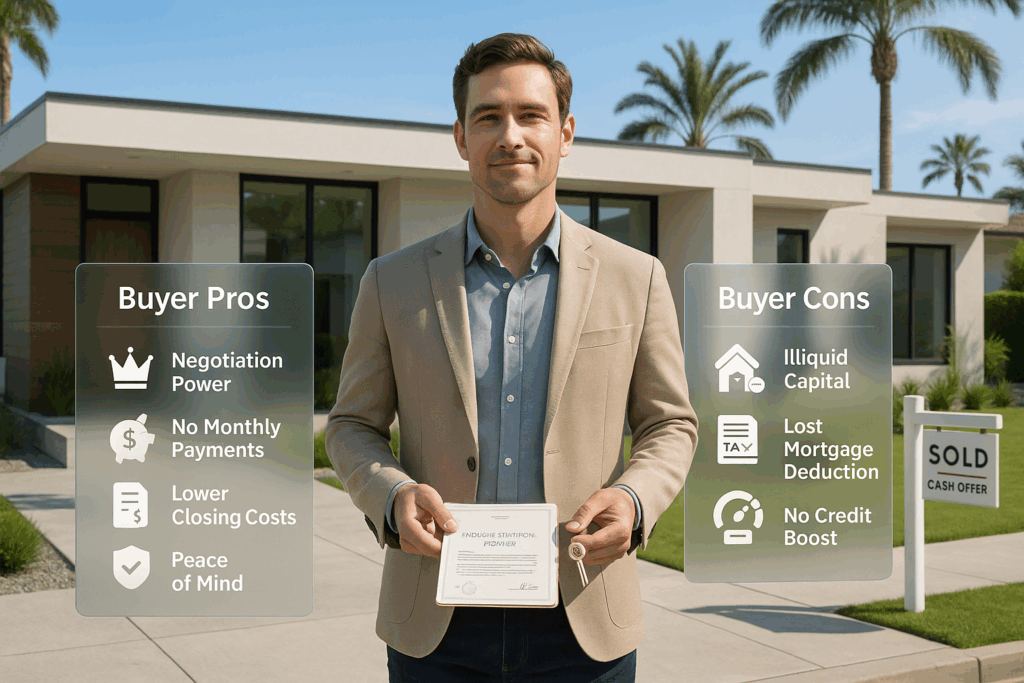

Why Would a Buyer Pay Cash? (Pros and Cons for Home Buyers)

We’ve covered why sellers love cash offers – but what about the buyers making these offers? If you are (or aspire to be) a cash buyer in real estate, there are some significant benefits on your side too:

- Stronger Negotiating Power: As a cash buyer, you have major leverage when negotiating with sellers. Your offer is automatically more attractive because it comes with certainty and can close quickly. This means you can sometimes get a house for a lower price than if you were using a loan. Sellers might accept a lower cash offer over a higher financed offer just to avoid the hassle and risk of a mortgage. In bidding wars, being the only (or the highest) all-cash bid can make your offer stand out. Essentially, cash is king: it tells the seller you’re serious and that there’s much less that can go wrong. This negotiating power can also help you snag other perks – for example, a seller might throw in appliances or accommodate your preferred closing date more readily for a cash buyer.

- No Monthly Mortgage or Interest Payments: This is obvious but worth highlighting – buying a home with cash means you won’t have a mortgage bill each month. You’ll own your home free and clear. Over the long run, this saves an enormous amount of money that would have gone towards interest. Consider that 30-year mortgage interest rates in 2025 have hovered around 6-7%. By paying cash, you avoid paying tens or even hundreds of thousands of dollars in interest over the life of a loan. You also don’t have to worry about fluctuations in interest rates, refinancing, or being tied to a mortgage for decades. This financial freedom can be very appealing – especially to retirees or anyone who values peace of mind over maximizing leverage.

- Lower Closing Costs & No Financing Fees: Buying with cash eliminates many fees that lenders charge. There’s no loan origination fee, no appraisal fee required by a lender, no mortgage insurance, and often a smaller slate of administrative fees. You’ll still have some closing costs (title insurance, escrow or attorney fees, property taxes, etc.), but overall, closing on a house with cash is cheaper than closing with a loan. Some estimates suggest you save a few thousand dollars in closing costs by not having a mortgage. Plus, since you’re not dealing with a bank, the process to close is simpler and often smoother – fewer documents to sign and less paperwork to sift through.

- Peace of Mind and Ownership Security: Owning your home outright can provide tremendous peace of mind. In uncertain economic times, not having a mortgage means you don’t have to worry about losing your home to foreclosure if you face financial difficulties later. You essentially immunize yourself from one big risk. Additionally, in a cash purchase, because you bypass the lender’s timeline, you can get into your new home faster. If you’ve sold your previous home or are relocating, this can reduce the period you’re in limbo or double-paying for housing. Some buyers also find that being able to say “I own my home outright” is a point of pride and financial security that’s hard to quantify.

However, buyers should also consider the drawbacks of paying cash for a house:

- Tying Up a Lot of Capital: Buying a home is expensive – especially in Los Angeles, where median home prices are quite high. Paying cash means you’ll be locking a large portion of your money into the house. That cash becomes illiquid; it’s now equity in the home. While your net worth still includes the home’s value, you can’t easily access that money if you need it for something else (except through selling or taking a loan against the house later). Some financial advisors argue that if you can get a low mortgage rate, you might be better off taking the loan and investing your cash in something that earns a higher return. So, one question to ask is: could your cash be put to better use than sitting in the bricks and mortar of your home? It depends on your financial situation and comfort with debt. Many cash buyers are willing to give up potential investment gains in exchange for the security of no mortgage.

- Missed Tax Benefits: Mortgage interest on loans is often tax-deductible (for those who itemize deductions on their taxes). If you pay cash, you won’t have any mortgage interest to deduct. Depending on your tax situation, this could mean missing out on some tax savings. That said, the 2017 tax law changes have made the mortgage interest deduction less impactful for many (due to higher standard deductions), and saving on interest outright might outweigh the lost deduction. Still, it’s a factor to consider, especially for high-income individuals who benefit from deductions.

- Limited Credit Building: This is minor, but worth noting: having and responsibly paying a mortgage can help build your credit history and credit score. If you never have a mortgage, you might lose out on that credit-building opportunity. However, most people have other loans or credit lines, so this isn’t a big concern, and certainly no one would suggest taking a mortgage just to build credit if you don’t need one.

Overall, cash home offers benefit buyers by saving money on interest and giving them a leg up in getting the house they want. If you have the means to do it, it can be a great strategy, especially in real estate markets like Los Angeles where desirable homes often have multiple bidders. Just ensure you’re not stretching your finances too thin; always keep an emergency fund even after emptying your coffers to buy the house.

Pro Tip: Some buyers use a hybrid approach. For instance, they might use a bridge loan or home equity line to effectively act as a cash buyer on a new home, then pay that loan off when their old home sells. This way they can make a cash-backed offer without having all the cash free at the start. Programs exist (some banks or companies offer “buy before you sell” programs) to help with this scenario. The bottom line is, being able to offer cash on a house – whether it’s truly your cash or through a special short-term loan – can significantly increase your chances of getting an offer accepted.

Frequently Asked Questions (FAQ) About Cash Offers

Q: What does a cash offer mean in real estate?

A: A cash offer means the buyer is proposing to buy the property outright with no financing contingency. They have the full amount of the purchase price available to pay without needing a mortgage loan. In practice, this makes the offer more straightforward and often more attractive to sellers, since there’s less uncertainty and usually a faster closing timeline. All-cash offers remove the lender from the equation, which means no waiting on loan approval and no worry about the deal falling apart due to financing issues.

Q: Does a cash offer literally mean the buyer pays in actual cash?

A: Not literally bags of cash, no. In a real estate context, “cash” just means no loan is involved. The buyer will typically wire the funds or provide a certified cashier’s check at closing for the full purchase price. It’s all legal and documented – no different from a normal sale except there’s no lender funding the payment. So when you hear “all cash offer”, think of it as “all funds ready and available now”. It’s a cash sale of the property in terms of financing, but you won’t see anyone handing over physical cash bills at the closing table.

Q: What is an “as-is” cash offer on a house?

A: An as-is cash offer means the buyer is agreeing to purchase the home in its current condition, without the seller having to make repairs or improvements. This is common with investor buyers or cash-for-home companies – they will take the property as-is (even if it needs work) because they plan to fix it themselves. For the seller, an as-is cash offer is convenient: you won’t be on the hook for repair costs, and you can sell your house for cash without worrying about passing a strict home inspection. However, as-is offers might come at a lower price to account for the cost of needed repairs. Always ensure the buyer still does a proper inspection so they know what they’re getting into; as a seller, you should disclose known issues, but an as-is term generally means you won’t renegotiate or fix things.

Q: What is a fair cash offer for my house?

A: A fair cash offer is one that reasonably reflects your home’s market value minus any costs or concessions the buyer is taking on for a quick purchase. To gauge this, consider your home’s condition and compare it to recent sales of similar homes in your area. If your house is in excellent shape and you’re in a hot market, a fair cash offer might be very close to the asking price – possibly even at or above asking if competition is high. If your property needs significant repairs or you require an ultra-fast closing, a fair offer might be somewhat lower to account for those factors. Remember that investor buyers will factor in their profit margin, so their offers will typically be lower than what you’d get from a regular homebuyer who plans to live in the home. Tricia Watts suggests talking to a trusted real estate professional or getting a no-obligation quote from a reputable cash buying company to see where the offers come in. If, for example, your home would likely sell for $500,000 on the open market but needs $50,000 in repairs, an investor might offer around $400,000 (market value minus repairs and a margin). That could be fair in that context. The key is transparency – understanding why a cash offer is at a certain number.

Q: Should I accept a cash offer for my house?

A: It depends on your priorities. Accepting a cash offer can be an excellent choice if you value a fast, hassle-free sale and less risk. Many sellers in Los Angeles who need certainty or a quick closing find that a slightly lower cash offer may actually net them more in the end when you subtract months of carrying costs (mortgage, taxes, utilities while waiting for a buyer) and avoid paying hefty agent commissions. On the other hand, if you’re not in a rush and your goal is to get the absolute highest price, you might lean towards listing on the market and entertaining all offers (cash or financed). Consider the specifics of the cash offer on the table: Is it reasonable? Is the buyer reputable? When do they want to close? Are they asking for any contingencies or are they pretty straightforward? Also factor in non-financial aspects: a cash buyer might let you stay in the home a bit after closing (rent-back) or may waive repairs, which could sway your decision. In summary, if the cash offer is fair and your top goal is a sure thing with minimal stress, it’s often worth taking. If you have time and you’re comfortable with some uncertainty, you could test the market for higher offers. Every situation is unique – don’t hesitate to discuss with a real estate advisor to weigh your options.

Q: What does it mean when a listing says “cash only” or “cash offers only”?

A: When a home is advertised as “cash only“, it signals that the seller will only consider cash offers (no financed offers). This could be for a variety of reasons. In some cases, the property might be in such condition that it won’t qualify for a mortgage – for instance, if a house is not up to code, has significant damage, or is missing critical components, many banks won’t lend on it. By saying cash only, the seller (or the seller’s agent) is essentially warning that traditional buyers using loans need not bother. In other cases, the seller just might not want any contingencies or delays; they might be an estate or bank (like in a foreclosure sale) looking to close quickly with a sure thing. If you’re a buyer and see “cash only,” understand that means you’ll need liquid funds for the full purchase price. If you’re a seller considering listing as cash only, use that term carefully – it will limit your buyer pool a lot, but it can save time if you know financing would be an issue. Often, listing terms “cash” are used by experienced investors selling off-market properties, or by banks selling foreclosures that need work.

Cash Offers Can Be a Win-Win in the Right Situation

Selling or buying a home is often a stressful experience, but a well-executed cash transaction can take a lot of the stress out of the equation. For sellers, an all-cash offer means a quicker sale with fewer what-ifs. For buyers, it means owning a home without debt and having a stronger hand to play during negotiations. In a dynamic market like Los Angeles, cash offers on houses have become a tool that savvy individuals use to stand out or speed things up.

That said, a cash sale isn’t the answer for everyone. It’s important to do your homework, ensure any cash home offer you consider is legitimate and fair, and make the choice that aligns with your needs and timeline. If you’re intrigued by the idea of a cash sale – whether you need to sell your house for cash fast due to personal circumstances or you simply want a smoother process – getting more information is a smart next step.

Call-to-Action: Ready to explore a cash offer for your Los Angeles home?

At MaxNet Homes, we specialize in helping homeowners sell on their terms. We can provide a fair, no-obligation cash offer for your property and walk you through the process with transparency and empathy. Led by Tricia Watts, a trusted local real estate professional, our team has the experience to answer your questions and ensure you feel comfortable every step of the way. Don’t let the traditional home-selling process overwhelm you. If you’re curious about getting a cash offer for your house, reach out to us today. Sell your home for cash confidently and conveniently – and move forward to your next chapter with peace of mind.