Introduction

Home appraisals can feel nerve-wracking – especially in a competitive market like Los Angeles. If you’re selling your house or refinancing, you might wonder what do appraisers look for in a home and how the appraised value is determined. Tricia Watts – owner of MaxNet Homes in Los Angeles – emphasizes that knowledge is power: “When you know what an appraiser looks for, you can address issues beforehand and feel more confident about the process.” In this guide, we’ll outline the key factors that influence your home’s appraisal and how you can use that insight to your advantage.

What is a Home Appraisal and Why It Matters

A home appraisal is a professional assessment of a property’s value by a licensed appraiser. Lenders require an appraisal whenever you purchase or refinance a home with a mortgage, to ensure they aren’t lending more than the home is worth. In practice, this protects both the bank and you as a buyer from overpaying. For example, if you agree to pay $800,000 for a house but it appraises for only $750,000, the bank will base the loan on the $750,000 value – potentially leaving a financing gap. From a seller’s perspective, a low appraisal can delay or derail a sale, so it’s crucial to understand how appraisals work.

The Home Appraisal Process: What to Expect

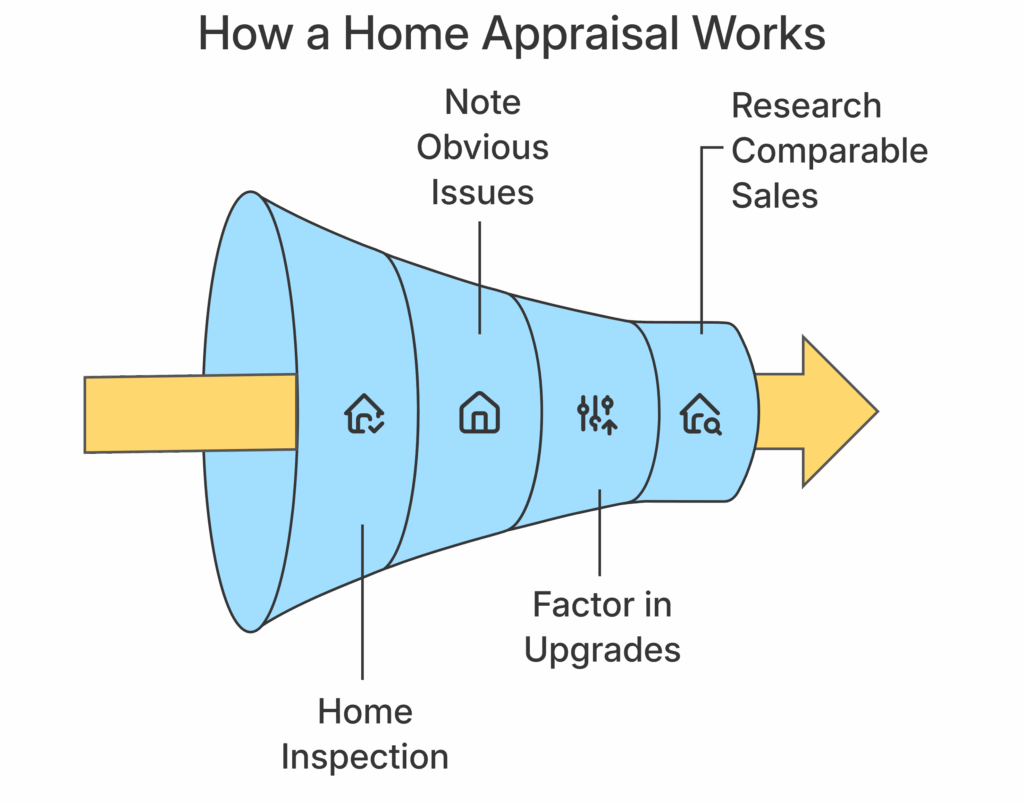

When the appraiser comes to your home, they will inspect the property inside and out. They measure the square footage, count the bedrooms and bathrooms, and evaluate the overall condition and features of the home. This means looking at elements like the foundation, roof, walls, flooring, windows, and any amenities (garage, fireplace, pool, etc.). Any obvious issues – such as a leaking roof or structural cracks – will be noted, as well as quality upgrades or unique features. The appraiser will also take photographs and document the layout.

Next, the appraiser factors in any improvements or upgrades you’ve made. Have you renovated the kitchen or bathrooms? Replaced an old roof or HVAC system? Added energy-efficient windows or new flooring? Appraisers give value to updates that enhance a home’s condition or functionality. (Tip: Be sure to inform the appraiser of any significant upgrades so they don’t overlook them.)

Finally, the appraiser researches comparable sales in your area. They will compare your home to similar houses that sold recently (usually in the past few months) in your Los Angeles neighborhood. By analyzing these comps, the appraiser can gauge the market value of your property. If comparable homes have been selling for, say, $750,000, your appraisal will likely come in around that range, adjusted up or down for differences in size, condition, and features.

Key Factors That Influence Your Home’s Appraised Value

Overall Home Condition

One of the biggest things appraisers evaluate is the condition of the property. A well-maintained home will almost always appraise higher than a similar home in poor shape. The appraiser will examine the structural integrity (foundation, roof, walls) and look for any signs of damage or deferred maintenance. For example, a roof with leaks or a foundation with cracks can significantly drag down value. They also check the internal systems (plumbing, electrical, HVAC) and general upkeep. Simple indicators like fresh paint, working fixtures, and no obvious repairs needed suggest the home has been cared for. On the other hand, evidence of problems – water stains (hinting at leaks), mold, or termite damage – will negatively impact the appraisal.

Size and Layout

In real estate, size matters. The square footage of your home and the number of usable rooms play a major role in valuation. Generally, more living space and more bedrooms/bathrooms equal a higher appraised value (within the context of your neighborhood and house type). The appraiser will compare your home’s gross living area and room count to the standard in your area. An efficient, functional layout is also beneficial. For instance, having a normal flow between rooms and a reasonable bedroom-to-bathroom ratio is ideal. While unique floor plans can be charming, anything that severely disrupts functionality (say, a bedroom only accessible through another bedroom) might lead the appraiser to make a slight value deduction. The key is that your home’s size and layout should reasonably match what buyers expect for a home of its type in Los Angeles.

Home Updates and Features

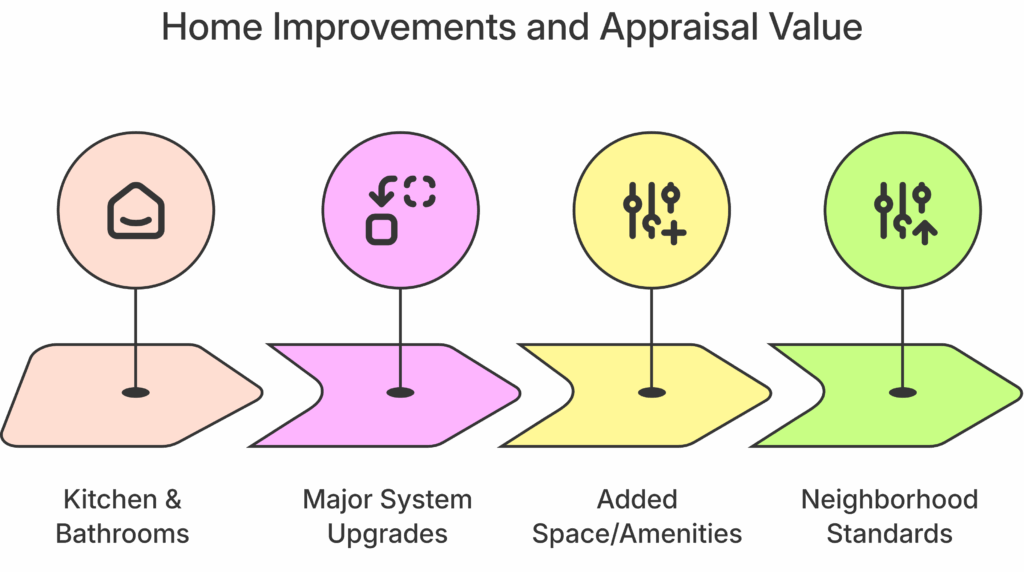

Upgrades and renovations can boost your home’s appraised value – but some improvements carry more weight than others. Generally, appraisers give the most credit to big-ticket updates that modernize the home or extend its life:

- Kitchen and Bathrooms: Modern, updated kitchens and bathrooms typically yield a strong return on investment in an appraisal. These are expensive for a buyer to renovate, so if you’ve already done it (new countertops, cabinets, appliances, updated fixtures), your home will likely be valued higher. Tricia Watts confirms that updated kitchens or baths are among the best improvements to increase a home’s value in the eyes of buyers and appraisers alike.

- Major Systems: Replacing an old roof, installing a new HVAC system, or upgrading electrical/plumbing can improve value — it signals the home has newer critical components. An appraiser will note if your roof or AC is brand new versus at the end of its life.

- Added Space or Amenities: If you built an addition or a permitted guest house/ADU, finished a basement, or added a garage, those create extra usable space and often raise the appraised value. Desirable amenities like energy-efficient windows, solar panels, or a new deck might add some value as well (though usually not dollar-for-dollar what you spent).

Keep in mind that not every improvement guarantees a higher appraisal. Luxury touches that overshoot what’s standard for your area may not get full credit. For example, spending $100k on a backyard pool doesn’t mean your home is worth $100k more – if most homes in your neighborhood have modest pools, the appraiser will assign a value comparable to those. In short, upgrades that make your home align with (or slightly outshine) the local market can help, but over-improving beyond neighborhood norms has limited payoff in an appraisal.

Location and Neighborhood

Your home’s location is a factor largely outside your control, but it heavily influences value. Appraisers consider where the property is: the neighborhood, block, and even exact positioning. In Los Angeles, being in a high-demand neighborhood (with good schools, convenient amenities, and low crime) will support a higher appraisal. The appraiser will note if your property is on a quiet, residential street versus a busy thoroughfare, and whether surrounding homes are well-kept. They also take into account any external factors that could affect value – for instance, proximity to a freeway or being under a flight path might detract a bit, whereas a nice view or a larger-than-average lot could add value. Additionally, appraisers reflect broader market conditions in the area. If home prices in your neighborhood have been rising rapidly, that trend will be factored into the appraisal (through the comparable sales). Conversely, if the market is cooling, the appraiser will temper the valuation accordingly.

Conclusion: Maximizing Your Home’s Value in Los Angeles

Understanding what appraisers look for in a house gives you an edge as a homeowner. By seeing your home through an appraiser’s eyes, you can address maintenance issues ahead of time and highlight upgrades that add value. Remember, an appraisal isn’t about your personal attachment to the home – it’s about the facts and figures of the property and recent sales data. But armed with knowledge of the process, you can better prepare and avoid surprises.

If you’re planning to sell your Los Angeles home, getting expert input can make all the difference. Tricia Watts and the MaxNet Homes team have extensive experience in the L.A. market and can help you strategize to maximize your net profit. From advising on smart pre-sale improvements to providing a realistic home value estimate, Tricia offers straightforward and empathetic guidance every step of the way.

Ready to take the next step? Contact MaxNet Homes today to discuss your home’s value or to get answers to any appraisal questions. We’re here to help you make the most of your Los Angeles real estate opportunities with confidence and peace of mind.

Latest Posts

- What Appraisers Look For in a House: Home Appraisal Guide for Los Angeles Sellers

- Los Angeles Housing Market Crash or Correction? 2024 Forecast & What It Means for You

- We Buy Houses for Cash in Los Angeles: Pros, Cons, and How It Works

- How Much Do Real Estate Agents Make on a Home Sale?

- LA Real Estate Trends 2025: Expert Market Analysis and Property Investment Insights