Los Angeles’ Trusted Home Buyer: We Buy Houses For Cash! No Repairs. No Commission.

How to Stop Foreclosure in Los Angeles – A Compassionate Guide to Saving Your Home

Facing the threat of foreclosure on your Los Angeles home can be overwhelming. The fear of losing the roof over your head – especially in LA’s tough housing market – is a very real, emotional rollercoaster. But you are not alone, and foreclosure does not have to mean the end of your homeownership journey. In this definitive guide, we’ll show you how to stop foreclosure in California, with a special focus on Los Angeles homeowners.

Key Takeaways

Understand the Process: California’s foreclosure timeline is relatively long, giving you time to act. In Los Angeles (and all of CA), lenders usually can’t start foreclosure until you’re 120 days behind, and you have up to 5 business days before the auction to bring the loan current. Acting early is critical.

You Have Options: There are multiple ways to avoid foreclosure in California, from loan modifications and repayment plans to ways to stop foreclosure immediately like filing for bankruptcy or selling your house quickly for cash. We’ll cover these options in plain language.

New Protections in 2025: A new foreclosure law in California (AB 2424, effective Jan 1, 2025) adds protections for homeowners. It requires foreclosure auctions to start with a minimum bid (at least 67% of fair market value), preventing homes from being sold for pennies on the dollar. This helps ensure fairer outcomes for families facing foreclosure

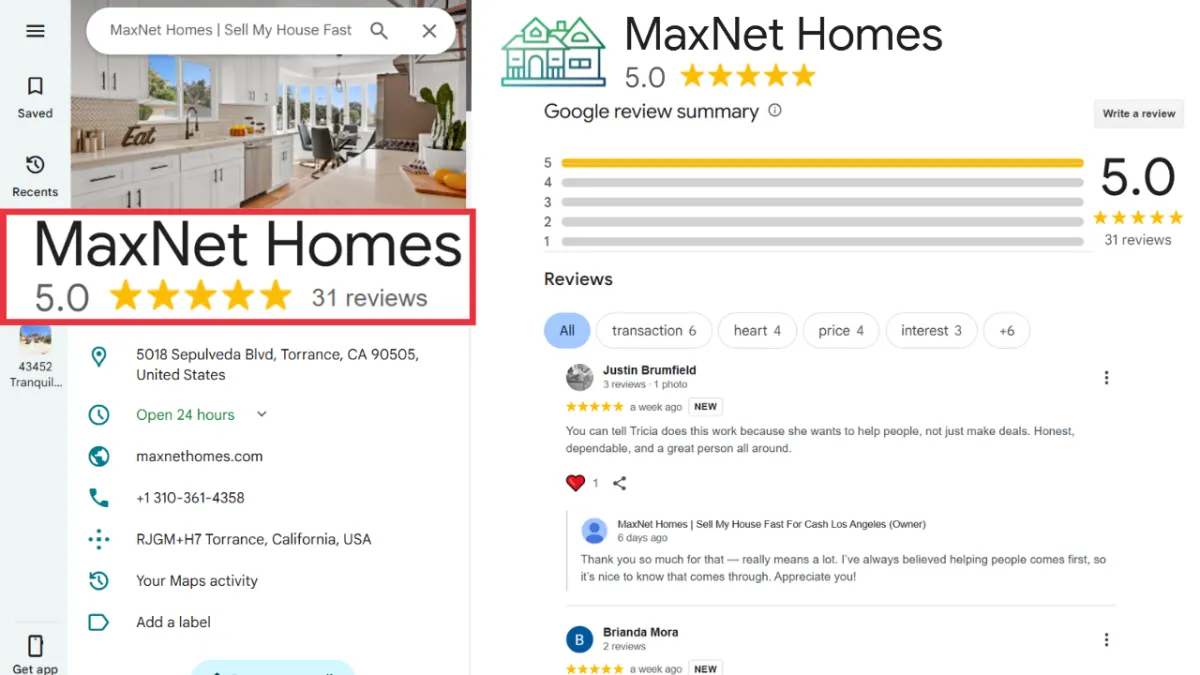

Local Expertise Matters: Los Angeles is unique – high property values, diverse neighborhoods, and local regulations mean you want advice tailored to Angelenos. Tricia Watts, founder of MaxNet Homes, and her team have years of experience helping LA homeowners navigate foreclosure by buying houses for cash quickly. MaxNet Homes is a BBB A+ accredited, 5-star reviewed local homebuyer, so you can trust their guidance and credibility.

You’re Not at the End: Most importantly, foreclosure can be stopped or avoided with the right approach. Many homeowners in LA have successfully overcome foreclosure by taking prompt action and enlisting help. This guide will show you that there is hope and actionable steps to protect your home or credit. We’ll even share a real customer story for inspiration.

Now, let’s dive into this step-by-step guide to how to stop a foreclosure in California, with strategies Los Angeles homeowners can use right now.

Call MaxNet Homes Today

1 844-MAXNET-8

Get Your Fast, Competitive Offer Today!

Why Do Los Angeles Homeowners Face Foreclosure?

Life in Los Angeles isn’t cheap. Many hardworking Angelenos live paycheck to paycheck due to high housing costs, so an unexpected hit can spiral into missed mortgage payments. Common reasons LA homeowners end up facing foreclosure include:

Job Loss or Income Reduction: The entertainment industry, tech, service jobs – Los Angeles has a diverse economy, but also one with frequent layoffs and gig work. Losing a job or hours can make that hefty CA mortgage unmanageable overnight.

Medical Bills or Unexpected Expenses: A health crisis or emergency expense can divert funds from the mortgage. With LA’s high cost of living, there’s often little cushion for surprise bills.

Adjustable Rates or Balloon Payments: Some Angelenos have adjustable-rate mortgages. When those rates reset higher (or a balloon payment comes due), the monthly payment can jump beyond what’s affordable, leading to default.

Divorce or Family Issues: Life happens – divorces, separations, or a death in the family can affect finances and who’s responsible for the mortgage. (MaxNet Homes often helps homeowners dealing with foreclosure, divorce, and other tough situations by buying houses fast for cash.)

Whatever the cause, falling behind on mortgage payments is incredibly stressful. It’s your home on the line. The good news is that foreclosure in California is a process, not an sudden event – and that process gives you opportunities to get out of foreclosure or even avoid foreclosure altogether if you act quickly.

Understanding the Foreclosure Process in California

In order to stop foreclosure, it helps to know what you’re up against. The process in California (including Los Angeles) has specific steps and legal timelines that every homeowner should know:

Pre-Foreclosure: After you miss a mortgage payment or two, you enter a grace period. Lenders in CA usually must wait until you’re 120 days late (about 4 months) before formally starting foreclosure. During this pre-foreclosure time, most banks will contact you or send letters. Tip: Don’t ignore them. If you’re struggling, reach out to your lender early and explain your situation. Many lenders have hardship programs or can offer a temporary fix if you communicate before things progress.

Notice of Default (NOD): This is the official start of foreclosure in a non-judicial foreclosure (which is most common in California). The NOD is a public notice from the lender saying you’re in default on the loan. It usually comes after about 3-4 months of missed payments. In California, once the NOD is recorded, you get 90 days to cure the default (catch up on payments). This 90-day period is your golden window to stop foreclosure by paying the arrears or working out another solution.

Notice of Trustee’s Sale (NOTS): If the 90 days pass and you haven’t resolved the default, the lender can issue a Notice of Trustee Sale, setting an auction date for your home. The notice must give at least 20 days’ warning before the sale date. The auction date will also be published in a local newspaper and posted on your property. At this point, you’re likely 6+ months behind on payments. It’s urgent, but you can still stop the foreclosure. In fact, California law lets you reinstate the loan up to 5 business days before the sale by paying the past-due amount plus fees. Even after that deadline, you might negotiate with the lender for a postponement if you’re close to a solution (though they aren’t required to grant it).

Trustee Sale/Auction: This is the foreclosure sale where your property is auctioned to the highest bidder (often the bank itself if no one else bids). Once the hammer falls, your home is sold. In California’s non-judicial process, there is no redemption period after the sale for the homeowner – meaning you generally can’t reclaim the home after it’s auctioned. That’s why it’s so critical to act before or at least by the auction stage. (One exception: in the less common judicial foreclosures, there’s a brief redemption window – usually 3 months, and only if the home sold for less than what you owed. But most LA foreclosures are non-judicial with no post-sale redemption.) After the sale, if you haven’t already left, an eviction process (Notice to Quit, then possibly an unlawful detainer lawsuit) will begin

The bottom line: When is it too late to stop foreclosure? In California, it’s essentially “too late” once the auction happens and the property is sold. Up until that point, you have options to save your home or at least avoid the final foreclosure hit on your record. Ideally, take action long before it gets to an auction.

Ways to Stop Foreclosure Immediately (When You’re Out of Time)

Sometimes life blindsides you, and by the time you seek help, that auction date is uncomfortably close. Don’t panic – even last-minute, there are ways to stop foreclosure immediately or almost immediately. Here are some urgent strategies to consider if you’re in a time crunch:

File for Bankruptcy (Chapter 13): Bankruptcy is a nuclear option, but it automatically halts foreclosure as soon as you file (thanks to the “automatic stay” rule). Chapter 13 bankruptcy is designed for restructuring debts – it can potentially give you time to catch up on the mortgage over a 3-5 year repayment plan. Pros: Instantly stops the sale and lets you keep the home while you make payments under court supervision. Cons: It’s complicated, hits your credit hard, and you must have enough income to stick to the payment plan. Only consider this if you’ve talked to a bankruptcy attorney and it’s truly your best/only option to save the house.

Emergency Loan or Refinance: If a sympathetic family member, friend, or private lender can loan you the money very quickly to reinstate the mortgage, this can stop the foreclosure. Similarly, a hard money refinance (using a private lender) could pay off the defaulted loan. These options are rare (and often high-interest), but for homeowners with significant equity in LA, a hard money lender might step in last-minute. Be cautious of scams! Only deal with reputable, licensed lenders – never sign away your deed to someone offering help without a trusted professional involved.

Loan Reinstatement Payment: Sometimes the simplest solution is the hardest – coming up with a lump sum to catch up on all missed payments, late fees, and foreclosure costs. If you recently came into money (bonus, tax refund, etc.) or can sell other assets to gather the needed cash, you can reinstate your mortgage by paying the arrears in full. Under California law, your lender must accept full reinstatement payment if you make it at least 5 business days before the sale date. After that, they may require full payoff. So if you have the means, a reinstatement payment is a direct ticket out of foreclosure – your loan goes back to normal as if you never missed a beat.

Each of these emergency tactics has pros and cons. The right choice depends on your situation – your finances, how much equity is in the home, and whether your goal is to keep the house or simply avoid the foreclosure record. Many Los Angeles homeowners in a crunch end up choosing a fast cash sale or bankruptcy as the quickest rescues.

Real customer story: One LA homeowner, Audrey, was desperate to avoid foreclosure on her family’s house. She had already moved out of the area and was juggling a new mortgage, so keeping up with the old house was impossible. Audrey found MaxNet Homes just two weeks before the foreclosure sale. Here’s what she said after we bought her house in the nick of time:

“Tricia at MaxNet Homes was there whenever we had a question and even handled our loan payoff so the process stayed smooth. We followed our gut despite warnings, closed in under two weeks, and got paid the next day. So grateful for a fast, stress‑free sale — thanks Tricia and MaxNet Homes.” – Audrey (5-star Google review)

As Audrey’s experience shows, selling your house fast for cash can be a lifesaver when foreclosure is looming. Instead of losing the home at auction and walking away with nothing but a damaged credit report, she was able to get a fair cash payout, settle her mortgage, and avoid the foreclosure entirely. “Closed in under two weeks” is not an exaggeration – MaxNet Homes and other reputable cash buyers truly can move that quickly in urgent situations.

Your Other Options to Avoid Foreclosure (Before It Gets Urgent)

We’ve covered the last-minute saves, but ideally you’ll take steps to avoid foreclosure before it reaches the eleventh hour. If you’re just beginning to fall behind or see trouble on the horizon, consider these less drastic foreclosure alternatives:

Loan Modification: A loan mod is a permanent change to your mortgage terms to make payments more affordable. This could mean adding missed payments to the loan balance, lowering the interest rate, extending the loan term, or even forgiving a portion of the debt in rare cases. California lenders (thanks in part to the California Homeowner Bill of Rights) must review you for available loan modification options if you apply – especially if it’s your first time behind on the loan. Reach out to your mortgage servicer and ask about “loss mitigation” options. If you can secure a loan mod, it can stop foreclosure and essentially give you a fresh start with a new payment plan.

Repayment Plan or Forbearance: If your financial hardship is temporary (say, you were unemployed for a few months but now you’re back to work), lenders might offer a repayment plan (where you pay the regular mortgage plus a bit extra each month until you’re caught up) or a forbearance (a short-term pause or reduction in payments). Forbearance was common during the COVID-19 pandemic – banks allowed homeowners to pause payments for 3, 6, even 12 months. After forbearance, you negotiate how to repay the missed amounts (often through a repayment plan or deferral to the end of the loan). Key point: You must communicate with your lender early. These solutions are only available if you ask for help before foreclosure is far along. Don’t be afraid to call your lender – they often prefer to work something out rather than foreclose, especially if you have a reasonable plan.

Refinancing: If your credit hasn’t been destroyed yet and your home still has equity, refinancing with a new loan could bail you out. A new lender pays off the old mortgage (ending the foreclosure threat), and you start fresh with the new loan. This only works if you qualify for the new loan (which can be tough if you’re already behind on payments). However, if your income is strong and the issue was a one-time setback or a high-interest loan, refinancing into a lower rate could solve the problem. Given rising interest rates, this isn’t as easy as it once was, but it’s worth exploring if you have decent credit or a co-signer.

Sell the House (Before Foreclosure): Even outside of an emergency last-minute sale, selling your home on the open market is a valid way to avoid foreclosure. If you have enough time (ideally a few months), you can list your home with a real estate agent and try to find a buyer. In Los Angeles’s housing market, demand is often high, so you might sell relatively quickly. Just remember that a traditional sale can take time – from finding a buyer to the escrow process (typically 30-45 days). If an auction is coming up soon, a traditional sale might not close fast enough. That’s where companies like MaxNet Homes come in – we can purchase your home as-is for cash with no agent commissions, and close on your timeline (often in days or weeks, not months). Even if you’re not in full crisis mode yet, a cash sale can be the surest way to avoid a looming foreclosure if you suspect you won’t dig out of the mortgage hole. You can sell my house fast and protect your credit from a foreclosure mark. Many homeowners choose this route to cut their losses early and move on with cash in hand.

Short Sale: What if you owe more on the house than it’s worth (i.e., you’re “upside down” or “underwater” on your mortgage)? Selling would not normally generate enough money to pay off the loan. In that case, you can request the lender’s approval for a short sale – meaning the bank agrees to accept whatever the house sells for, even if it’s less than the loan balance, and forgive the remaining debt. Short sales do affect credit (it’ll show that you settled the mortgage for less than owed), but a settled debt is far better than a foreclosure in terms of future lending. In California, short sales require a real estate agent to handle the transaction, and they can be complex (lots of bank paperwork and waiting for approvals). However, a company like MaxNet Homes can often work with you and your agent to present a short sale offer to the bank. We’re very familiar with the process and can make a fair market offer quickly. If the bank approves, the foreclosure is stopped and you walk away without the burden of the upside-down loan. It’s not a happy ending, but it’s a dignified exit that lets you recover faster.

Deed in Lieu of Foreclosure: This is essentially giving the property back to the bank instead of them foreclosing. You sign over the deed, and in exchange the lender releases you from the mortgage. It’s less common, because banks often prefer money over homes, but some will agree to it if a sale isn’t working out. Typically, the house must have no other liens (second mortgages, tax liens, etc.) and you likely need to vacate the home. A deed in lieu still hits your credit (similar to a foreclosure in impact), but it’s slightly better since you cooperated and ended the process early. It also may come with an agreement that the bank won’t pursue you for any deficiency (remaining loan balance) – in California, most residential loans are non-recourse anyway, meaning you aren’t liable for a deficiency after foreclosure on your primary home. Still, getting it in writing via a deed in lieu is peace of mind. This option is usually a fallback if you can’t sell the house in time. Consider it the last resort if you want to walk away without the auction drama. Always get legal advice before doing a deed in lieu, to ensure you’re truly released from liability.

In summary, how to avoid foreclosure in California comes down to being proactive. The moment you realize you’re headed for trouble, start exploring these options. The sooner you start a loan mod, list the house, or contact a cash buyer, the greater the chance you’ll succeed in stopping the foreclosure. Every homeowner’s situation is different – maybe you just need a few months of breathing room (forbearance), or maybe the debt is insurmountable and selling is smartest. By understanding all these tools, you can make the best decision for your family.

(Quick note: California has resources like HUD-approved housing counselors and nonprofit organizations that offer free foreclosure avoidance counseling. The LA County Department of Consumer and Business Affairs, for example, can connect you with trusted help. Be wary of any “foreclosure rescue” firm that charges upfront fees or guarantees they can save your home – many are scams. Legitimate help won’t ask for big fees or for you to sign away your property.)

New 2025 Foreclosure Law Helps California Homeowners

Earlier we mentioned a new foreclosure law in California that recently went into effect. Let’s explain what that is, because it’s especially relevant for homeowners in Los Angeles with home equity to protect.

Assembly Bill 2424 (AB 2424) – effective January 1, 2025 – introduced a Minimum Sale Price Requirement for foreclosure auctions. In plain English, this law says banks can’t auction your home for dirt cheap just to wipe out the loan. They must establish the fair market value of the property before the sale and the opening bid has to be at least 67% of that value. If nobody bids that high, the sale is postponed and tried again later.

Why does this matter to you? It means if you do unfortunately lose a home to foreclosure, it’s more likely to sell for a reasonable price, which could fully pay off your loan and even return excess proceeds to you (in California, if a foreclosed home sells for more than the loan and costs, the former owner gets the surplus). Before this law, a home might sell for a shockingly low amount at auction, which was good for bargain-hunting investors but awful for the homeowner and neighborhood. Now there’s a safety net ensuring a more fair price.

Of course, our goal is to help you avoid ever facing that auction. But it’s nice to know California is adding protections for homeowners. This law shows that the state recognizes the foreclosure process needed reform to prevent “fire sale” prices. It’s an added layer of fairness for Angelenos who might be in this tough spot.

Keep in mind, AB 2424 doesn’t stop foreclosure or help you keep the house – it just makes the outcome a bit less damaging financially if the home is sold. Your best bet is still to pursue one of the earlier solutions we discussed to stop the foreclosure altogether.

Los Angeles Foreclosure Experts – We’re Here to Help

By now, you’ve learned that even if you’re screaming internally “I need to sell my house fast in Los Angeles!” or “How do I get out of foreclosure?!”, there ARE answers. As a homeowner, you have more power than you might feel you do in this moment. The key is taking action and reaching out for the right help.

This is where MaxNet Homes comes in as a trusted local resource. We’re a family-owned real estate solutions company based right here in Southern California. Our founder, Tricia Watts, started MaxNet Homes with a simple mission: make selling a home easier and kinder, especially for people in tough situations. Tricia has a tremendous knack for problem-solving and a heart for helping homeowners who are under stress. (Fun fact: she was even featured on HGTV’s Flipping 101 with Tarek El Moussa, showcasing her skill in turning distressed properties into beautiful homes!).

*What MaxNet Homes offers is a compassionate, no-pressure way to sell your home fast before foreclosure. We aren’t here to lowball you or take advantage of your situation – we truly want to create a win-win outcome where you get relief (and a fair cash price) and we acquire a property to renovate or resell. It’s a no-obligation process: we’ll evaluate your home and situation, explain all your options (sometimes we even advise homeowners that a loan mod or listing with an agent would be better for them – because it’s about your best outcome, not our bottom line). If a direct cash purchase makes sense, we can make you a competitive cash offer in 24 hours and close in as few as 7 days, or on whatever timeline works for you. There are no fees, no commissions, and we buy as-is, so you don’t have to fix a thing or clean up. We even handle the paperwork and coordinate with your lender to pay off the loan balance. As Audrey mentioned in her review, we’ll even communicate with your lender to handle the payoff and any foreclosure postponement logistics, making the process smooth for you.

MaxNet Homes has helped numerous homeowners across Los Angeles County avoid foreclosure. Whether you’re in Los Angeles proper or a smaller community like Los Banos, the foreclosure process and your options are the same statewide. (So yes, if you need to stop foreclosure on my home Los Banos, the strategies in this guide apply just as much as they do in L.A.!) The difference with us is that you’re working with a local team that understands the SoCal market and truly cares. We have an A+ rating with the BBB and dozens of 5-star Google reviews praising Tricia and our team for being responsive, honest, and effective. We’re not some big impersonal corporation; when you call MaxNet, you’ll likely speak directly with Tricia or a senior team member who will treat you like family.

Ready to Get Relief? Here’s Your Next Step

If you’re a Los Angeles homeowner facing foreclosure – or even just falling behind and exploring how to avoid foreclosure in California – don’t wait until things get worse. Reach out to MaxNet Homes for a friendly, no-commitment chat about your options. We’re happy to answer questions and share our expertise, whether or not you end up working with us. Sometimes just understanding that someone has your back can alleviate a huge weight of stress.

Get in touch with Tricia and the MaxNet Homes team today to see how we can help you stop foreclosure in California before it goes any further. You can call us at 1-844-MAXNET-8 or fill out a quick form on our website to get started. We’ll provide a free, confidential consultation and a cash offer if you’re interested in selling. Even if you’re not sure about selling yet, we can give you insights into the foreclosure timeline specific to Los Angeles and what steps you should take right now.

Remember, you have options and you have support. Foreclosure might feel like an unstoppable train, but with the right action plan, you can hit the brakes. Whether it’s working with your lender, consulting an attorney, or choosing a trusted home buyer like MaxNet Homes, there is a solution to fit your needs. Many homeowners before you have gotten through this, and so can you.

Don’t let foreclosure define your future. Take back control today – explore your options, ask for help, and make the choice that’s best for your family. If selling quickly for cash turns out to be that choice, MaxNet Homes is here to give you a fair offer and a fresh start.

You’ve got nothing to lose (except that knot in your stomach). Let’s stop this foreclosure together and get you on the path to financial peace.

Los Angeles Cash Home Buyer Reviews

See why homeowners across Los Angeles trust MaxNet Homes when they need to sell a house fast for cash.

Our 5-star reviews speak for themselves — real sellers sharing real experiences about smooth, honest, and hassle-free sales.

As one of the most trusted cash home buyers in Los Angeles, we’ve built our reputation on transparency, fair offers, and quick closings.

Before you sell your house to anyone else, take a minute to read what local homeowners are saying about working with MaxNet Homes.