Introduction

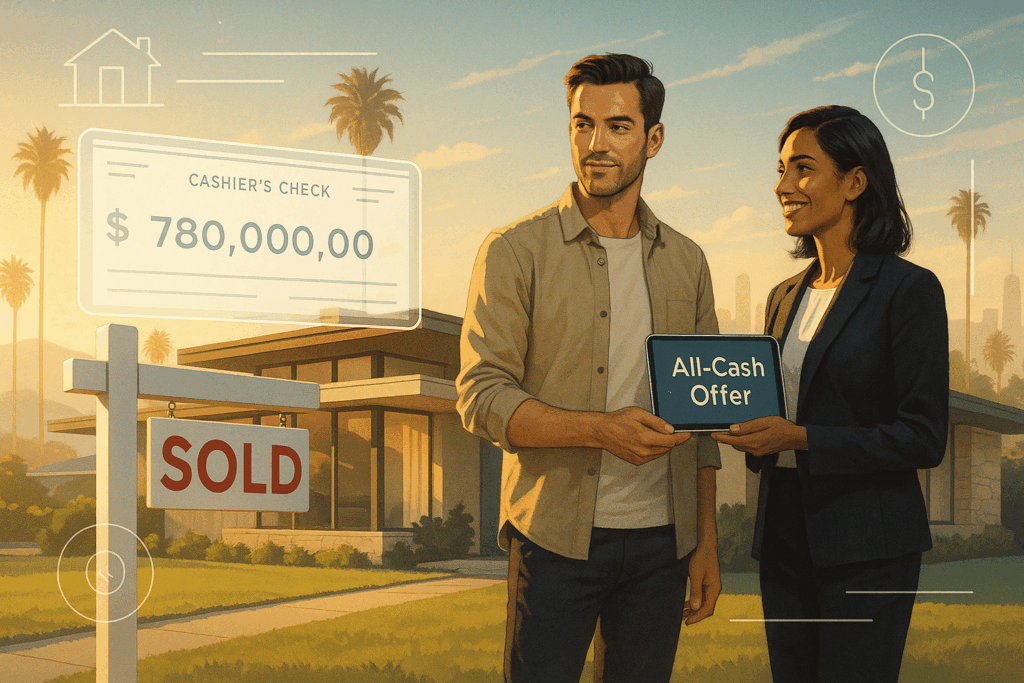

In a competitive real estate market like Los Angeles, you may have heard the buzz about homes selling for all cash. Perhaps you’ve even received a cash offer for your own house or seen listings bragging “cash offers only.” So, what is a cash offer in real estate, and why do sellers and buyers care? Simply put, a cash offer means the buyer is purchasing the home outright without a mortgage loan. They’ll pay the entire price up front (usually via wire transfer or cashier’s check, not literal stacks of bills). This approach can make a huge difference in how quickly and smoothly a sale happens. In fact, nearly 30% of U.S. home sales as of early 2025 were all-cash transactions, and about 23% of Los Angeles County homes sold in a recent month went to cash buyers.

Why are cash offers so popular? Tricia Watts – owner of MaxNet Homes in Los Angeles – explains that a cash offer can be a huge relief for home sellers: “Selling a house is stressful enough. An all-cash offer often means a smoother, faster sale with far fewer headaches for the seller.” In this guide, we’ll break down everything L.A. homeowners need to know about cash offers: what a cash offer entails, how it works, who typically makes these offers, and pros and cons for you as a seller. By the end, you’ll understand if accepting a cash offer for your home makes sense – and how to navigate the process with confidence.

What Does a Cash Offer Mean in Real Estate?

A cash offer on a house means the buyer is not relying on a mortgage or any form of financing. Instead, the buyer has the funds readily available to purchase the home outright. In practice, “cash” just refers to cash in the bank – the payment is usually made via a certified check or electronic transfer at closing. The key point is that there’s no lender involved. This distinguishes a cash offer from a traditional offer that comes with a mortgage contingency (where the sale depends on the buyer securing a loan).

Because no bank financing is needed, cash offers eliminate one of the biggest sources of delay or failure in a real estate deal: loan approval. Sellers don’t have to worry about a buyer’s loan falling through at the last minute. An all-cash offer on a house essentially tells the seller, “I have the money ready to go, so we can close quickly without any bank red tape.” It’s a more straightforward sale – which is why sellers often find a cash offer for their home very attractive.

How Common Are Cash Offers? All-cash offers are more common than you might think. As mentioned, roughly one in three home sales nationwide are now done in cash. In Southern California and Los Angeles, cash transactions have also become more frequent in recent years, comprising about a quarter of sales. This rise in cash purchases is driven by several factors: higher mortgage interest rates (making loans less appealing), intense competition for desirable homes, and many buyers having more equity or savings to leverage. The bottom line is that cash offers are no longer rare – they’re a significant part of today’s real estate landscape, especially in hot markets.

All-Cash Offer vs. Traditional Offer: When you receive a cash offer, it might even be labeled as “all-cash” in the purchase contract. For the seller, this means a potentially faster and more certain sale. For the buyer, making a cash offer can be a strategic move to stand out from other bidders. (After all, if you’re selling a house and one buyer can pay cash immediately while another must go through 45+ days of loan processing, which offer would you favor?)

One thing to note: A cash sale doesn’t mean there are zero closing formalities. You’ll still go through the standard closing process – signing documents, transferring title, etc. – but many steps are streamlined. Without a lender, there’s no loan underwriting, no appraisal required by a bank, and typically fewer contingencies. This can cut down the timeline dramatically. (We’ll detail the process next.)

How Does a Cash Offer on a House Work? (Step-by-Step)

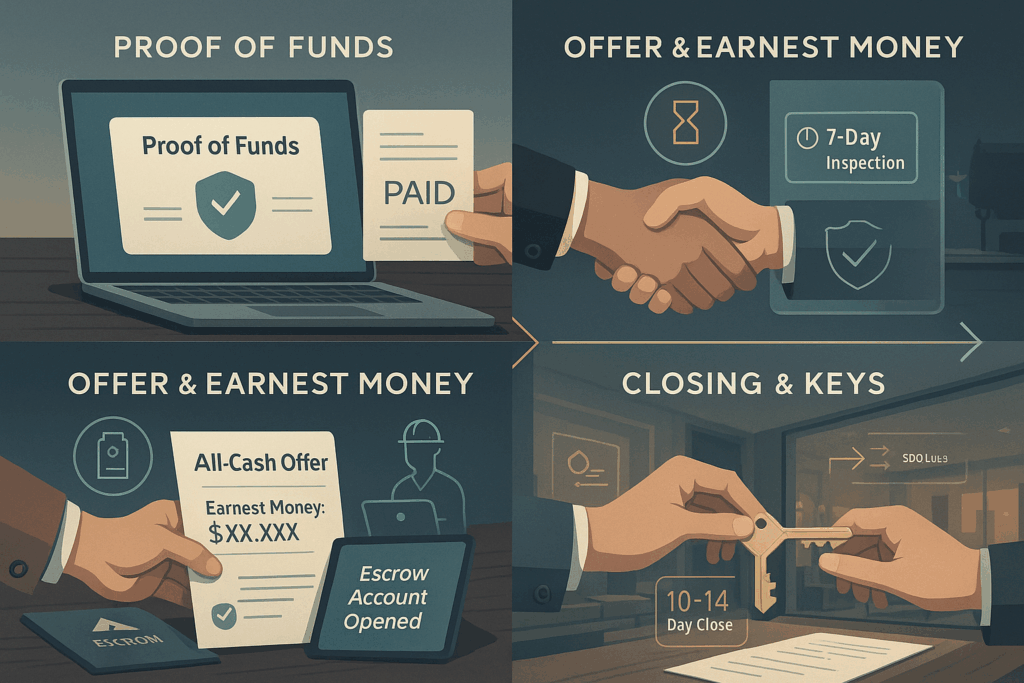

A cash real estate transaction follows the same general stages as any home sale, but with fewer hurdles. Here’s an overview of the cash offer process from start to finish:

- Buyer Makes an All-Cash Offer: The process begins when a buyer submits a purchase offer stating they will pay cash for the home. The offer will include the proposed price and any terms or contingencies. Smart cash buyers often provide proof of funds (a bank statement or letter from their financial institution) to show they truly have the money available. The seller reviews the offer, and because there’s no financing involved, the offer’s strength often comes down to the price and terms (like the closing date or any inspection contingency) without worrying about the buyer’s loan qualifications.

- Offer Acceptance and Contract: If the seller is happy with the price and terms, they’ll accept the offer. Both parties then sign a purchase agreement, a legally binding contract outlining the details of the sale. At this stage, the buyer will usually deposit earnest money (good-faith money) into an escrow account to demonstrate their commitment. With a cash offer, the earnest money might be a sizable amount, but it’s ultimately applied toward the purchase at closing.

- Due Diligence – Inspections and Appraisal (Optional): Even in an as-is cash offer, the buyer can still perform home inspections or other due diligence. Just because there’s no lender doesn’t mean the buyer won’t check the property’s condition. Typically, within a short period (often 7-10 days), the buyer will hire an inspector to look for any issues with the house. Unlike financed sales, a cash buyer might waive the appraisal requirement (since no bank is forcing an appraisal); however, some cash buyers still choose to get an appraisal or comparative market analysis to ensure they’re not overpaying. After inspections, the buyer may negotiate repairs or a price adjustment if something significant comes up – although many cash buyers purchasing homes “as is” will skip repair negotiations and accept the home in its current condition.

- Title Search and Escrow: Meanwhile, the title company or closing attorney will perform a title search on the property. This ensures there are no liens, claims, or ownership disputes that could affect the sale. The buyer will also finalize arranging their funds. Often, they’ll move the purchase amount into an escrow account prior to closing. Escrow is a neutral holding account managed by a third party (title company or escrow agent) that keeps the money safe until all conditions of the sale are met. Because it’s a cash sale, this step happens quickly – no waiting on loan funding, just verification of the buyer’s cash. Tip: As a seller, it’s wise to verify the buyer’s proof of funds early on, and certainly before closing, to make sure the cash is real and ready.

- Closing the Deal: Here’s where a cash offer really shines. With no lender delays, the closing can happen in as little as a week or two once the contract is signed and title is clear. At closing (often at a title company office), the buyer signs the final documents and transfers the funds for the purchase price. This is usually done via wire transfer or certified check for security. The seller, in turn, signs the deed and any other paperwork needed to transfer ownership. Because no mortgage is involved, the closing is typically much quicker and involves far less paperwork than a financed closing. You might go from offer acceptance to sold in 10-14 days, compared to the 30-60+ days a financed sale can take.

- Transfer of Ownership: Once closing is complete, the sale is official! The deed gets recorded with the county, transferring the property to the buyer’s name, and the seller hands over the keys. The seller receives the payment (often via a wire from the escrow account to their bank). Congratulations – the house is sold, and it probably happened faster and with fewer twists and turns than a traditional sale.

Quick note on timing: In a typical home sale with a mortgage, it takes an average of over 40 days just for the buyer’s loan to close after contract, on top of the time it took to find a buyer in the first place. That whole process can easily stretch to 2-3 months or more. With a cash offer, you cut out the longest step (the loan). It’s not uncommon for cash sales to close in under two weeks if everything is ready, versus the ~73-day average timeline for a conventional sale. This speed is one of the biggest appeals of cash offers for sellers who are eager to move quickly.

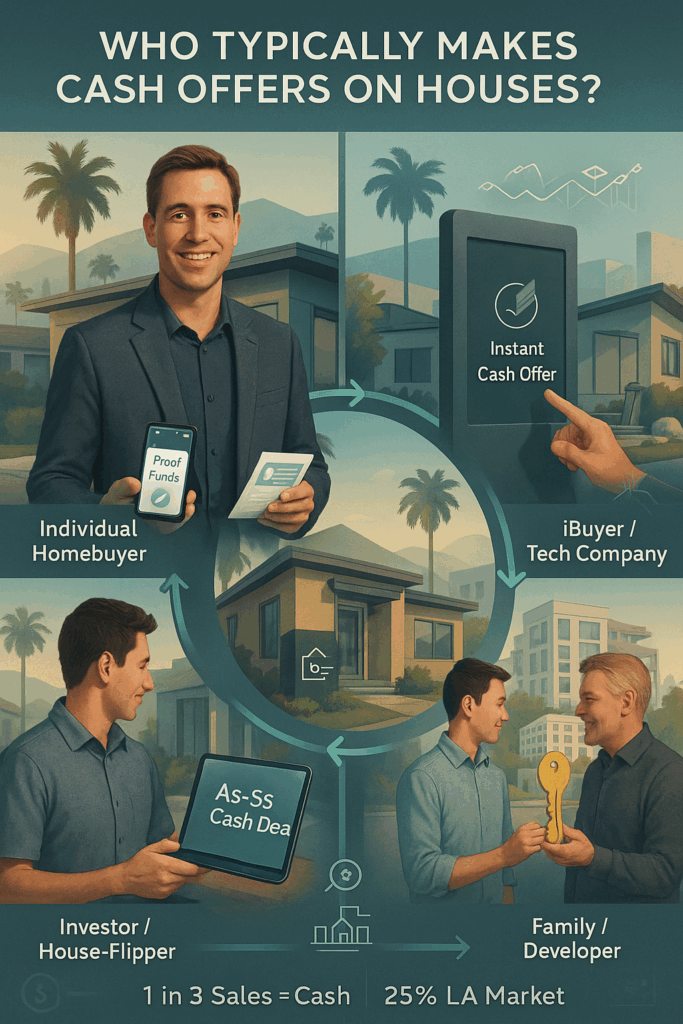

Who Typically Makes Cash Offers on Houses?

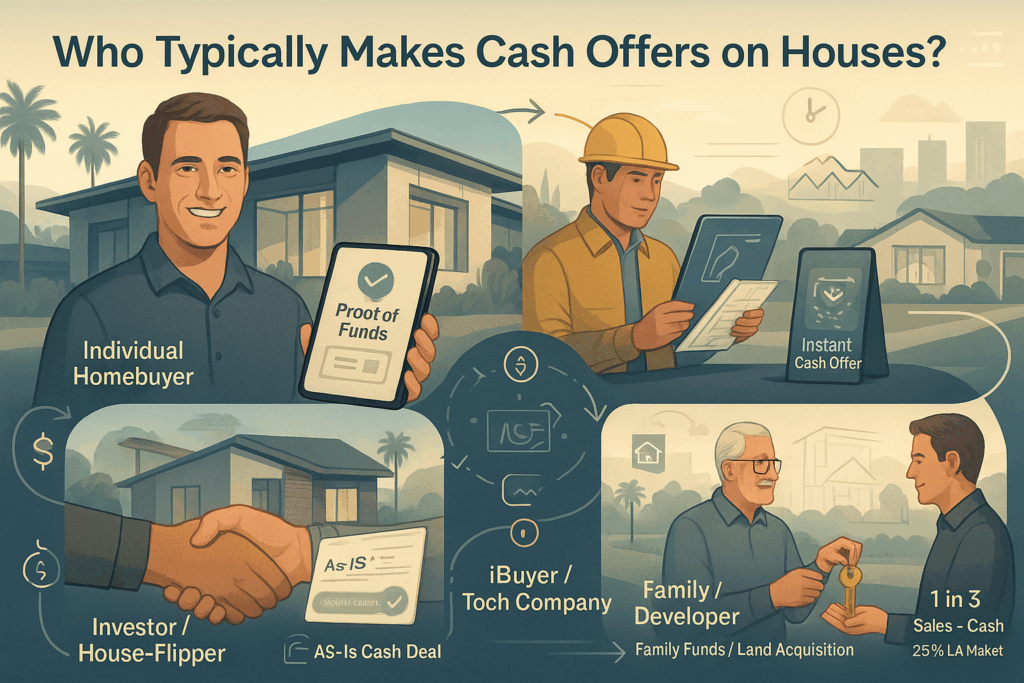

If someone is buying a home with cash, who are they? In Los Angeles and elsewhere, cash buyers generally fall into a few categories:

- Individual Homebuyers with Liquid Assets: These are regular homebuyers (often owner-occupants) who happen to have the funds available to purchase without a loan. How might they have so much cash? Common scenarios include move-up buyers who recently sold another property and are rolling over a large amount of equity, retirees or downsizers using proceeds from a previous home sale, or high-net-worth individuals who have significant savings or investments. In markets like LA, we also see well-off professionals or overseas buyers who prefer to pay cash. Some buyers choose to liquidate stock portfolios or get help from family to make a strong cash offer on a house. Their motivation is often to avoid debt and win the deal in a competitive situation.

- Real Estate Investors and House-Flippers: A significant portion of cash offers come from investors. These include local house flippers, rental property investors, and “We Buy Houses” companies that advertise fast cash deals. Companies like MaxNet Homes (right here in Los Angeles) are cash home buyers – they purchase houses directly for cash, often as is, then typically renovate or resell them. House flippers pay cash so they can close quickly, fix up the home, and flip it for a profit. Buy-and-hold investors (landlords) might also pay cash to acquire a rental property without a mortgage, aiming to generate immediate rental income. These investors often make straightforward cash offers and can close on your timeline, which appeals to sellers who want a hassle-free sale.

- iBuyers and Tech Companies: In recent years, some large tech-driven real estate companies known as iBuyers have entered the market (examples include Opendoor, Offerpad, and previously Zillow Offers). These companies make instant cash offers on homes through an online process. They have algorithms to price homes and can give you a quote quickly. iBuyers typically operate in certain price ranges and areas (some parts of LA included) and charge service fees for the convenience. While some iBuyers have pulled back when markets shift, they remain players who make all-cash offers on houses and close fast, similar to local cash investors.

- Buyers Who Don’t Need a Loan for Other Reasons: This is a broader category, but sometimes a family member or friend might offer to buy someone’s house for cash (for instance, parents helping an adult child buy a home outright). Also, developers who purchase properties (perhaps tearing down an old home to rebuild) often pay cash as part of land acquisition. In any case, the unifying trait is these buyers have funds readily available.

Why do these buyers pay cash? There are various reasons: Investors want to renovate and resell quickly (a mortgage would slow them down or complicate profits), while individual cash buyers might want to avoid paying interest or make their offer more attractive to the seller. In a high-price area like Los Angeles, paying cash is not feasible for everyone, but those who can do it enjoy a leg up in negotiations. As one real estate agent observed, many cash buyers “aren’t paying too much attention to interest rates” – by sidestepping loans, they also sidestep the cost of borrowing. For sellers, knowing the type of cash buyer you’re dealing with (family, flipper, iBuyer, etc.) can help set expectations during the sale.

Why Are Cash Offers Attractive to Home Sellers?

If you’re selling your home, you might wonder: Should I accept a cash offer for my house? What’s in it for me as the seller? Here are the key benefits of a cash offer from a home seller’s perspective:

- Faster Sale and Closing: Speed is often the #1 advantage. With no loan underwriting or appraisal required by a lender, a cash sale can close in days rather than months. You can get to the closing table in as little as 7-14 days, versus potentially 60+ days in a financed sale. This is ideal if you need to sell your home fast – whether you’re relocating for a job, dealing with financial issues, or just eager to move on quickly. A speedy sale also means you save on carrying costs (mortgage payments, taxes, insurance, utilities) that you’d otherwise pay while waiting for closing.

- Higher Certainty & Less Risk: A cash offer comes with far fewer “what-ifs.” You don’t have to worry about the buyer’s financing getting denied at the last minute or an appraisal coming in low. The deal is less likely to fall through. Once you’ve verified the buyer’s proof of funds and signed the contract, it’s very likely to close successfully. This peace of mind can be worth a lot – especially in Los Angeles, where buyers often make offers and then have to back out due to loan issues or other complications in a traditional sale. With a cash buyer, those uncertainties are minimized. There’s also typically no need for the buyer to include a financing contingency, which is one less contingency that could derail the deal.

- No Appraisal (Sometimes): In a conventional sale, even after you find a buyer, the bank’s appraisal could put your deal in jeopardy (if the home appraises below the agreed price, the lender might not approve the full loan). Cash buyers may choose to skip a formal appraisal. All-cash offers often come with an appraisal waiver, meaning the sale isn’t contingent on appraisal. That removes a common stress point for sellers – you won’t have an appraiser potentially valuing your home lower than the offer amount at the 11th hour. (That said, a savvy cash buyer will usually have a good sense of your home’s value before making the offer, so it’s not like they are blind to the price. They’re just not bound by a lender’s opinion of value.)

- Sell “As Is” (Fewer Repairs or Prep): One huge perk of many cash sales – especially when dealing with investors or cash-for-home companies – is that they often buy homes as is. That means you don’t have to invest time or money fixing the place up. No costly roof repairs, no repainting, no staging the home for dozens of showings. For example, MaxNet Homes will make a cash offer on your house as is, so you can skip repairs and cleaning altogether. This is a relief for sellers whose properties need work or for those who just don’t want the hassle of prepping for the traditional market. Even if the cash buyer does an inspection, they’re usually more understanding of issues and less nitpicky about asking for fixes, because they expect to handle repairs themselves (especially true for flippers).

- Convenience and Simplicity: Overall, a cash sale is generally more convenient. With fewer parties involved (no mortgage broker, underwriter, bank appraiser, etc.), communication is direct and simple. There are also no mortgage-related fees to worry about on the seller’s side (and the buyer saves on loan fees too). You often avoid having to keep your home in show-ready condition for weeks on end. Many cash buyers will even allow you to pick a flexible closing date that suits your schedule, since they’re not waiting on a loan approval. This can all add up to a less stressful experience. Tricia Watts notes that when her team buys houses for cash, “we handle all the details so the seller can just focus on their next step, not on paperwork or buyer loan drama.” The streamlined nature of cash deals is a big plus if you value an easy transaction.

- Potential Savings on Realtor Commissions (in certain sales): This isn’t universally true, because you might still work with a real estate agent even if you get a cash offer. But some homeowners who sell directly to an investor or through a cash-offer platform might avoid paying the typical 5-6% agent commission. For instance, if you sell directly to a company like MaxNet Homes, you’re dealing with the buyer (who is also an agent in this case) directly – meaning no listing agent commission on your side. Be sure to clarify this, but it’s possible to save on fees in a direct cash sale. (Keep in mind, though, real estate agents can also bring you cash buyers and help evaluate offers – so there’s value in having an agent’s guidance, especially if you’re comparing multiple offers.)

Bottom Line: From a seller’s viewpoint, a fair cash offer can feel like hitting the “easy button” on your home sale. You get a quick, sure deal with minimal hoops to jump through. It’s no wonder sellers often lean toward the certainty of a cash offer if the price is reasonable.

Are There Downsides to Accepting a Cash Offer?

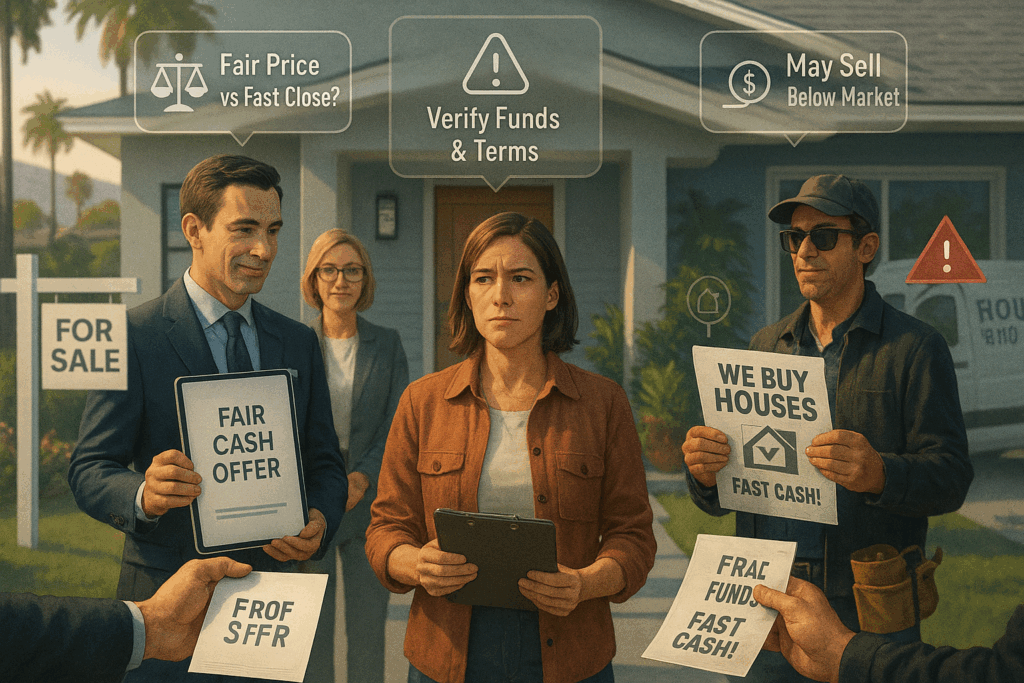

With all those benefits, you might be thinking a cash offer sounds perfect. But it’s important to consider potential trade-offs and ensure you’re getting a fair deal. Here are a few points of caution when dealing with cash offers on your home:

- Cash Offers Might Be Lower: The convenience and speed of a cash sale can come at a price – literally. It’s not uncommon for cash buyers (especially investors) to offer less than market value for your house. They know that a cash offer with a quick close is attractive, and in exchange, many expect a bit of a discount. For example, an investor might offer, say, 5-15% below what you might get from a buyer who needs a mortgage. In some instances, cash buyers pay less than financed buyers. A traditional buyer using a loan might stretch to offer a higher price (especially if they’re competing in a bidding war), whereas a cash investor will often aim for a bargain to maximize their profit. This doesn’t mean all cash offers are lowballs – in hot markets like Los Angeles, we’ve even seen cash buyers match or beat financed offers to win a prime property. But as a seller, be aware that the “fast cash” comes with a trade-off. You should still evaluate if the offer amount is fair for your home’s value.

- Beware of Lowball or Unethical Buyers: Unfortunately, not every “cash buyer” has your best interests in mind. You might encounter opportunistic investors who make super low offers hoping you’re desperate enough to accept. Or some may use high-pressure tactics to get you to decide quickly. Tricia Watts cautions sellers to do their homework: “Not all cash buyers are the same. A trustworthy cash buyer will offer a fair price and be transparent. We’re here to help – not to haggle.” Pay attention to a buyer’s reputation. Check reviews or ask for references if it’s a company. Red flags include extremely low offers with no explanation, or a buyer who refuses to show proof of funds. The good news is, many cash buying companies (MaxNet Homes included) pride themselves on fair, win-win deals – you just need to pick the right partner.

- You Might Leave Some Money on the Table: If your top priority is getting the highest possible price and you’re not in a rush, a cash investor’s offer could feel underwhelming. By selling on the open market (listing your home and waiting for buyers who might use loans), you might attract higher offers, especially if multiple buyers bid up the price. Cash buyers know you value the ease of their offer, and they factor that into the price. So ask yourself what’s most important: Is it a fast, guaranteed sale or squeezing out every last dollar? In many cases, the difference isn’t huge, but it could be a factor. Some sellers negotiate by shopping around – for instance, getting multiple cash offers from different investor buyers, or consulting a real estate agent to estimate what your home could fetch with a traditional sale. This due diligence can give you confidence that the cash offer you accept is reasonably close to market value given the convenience you’re getting.

- Verify the Funds and Terms: Even when accepting a cash deal, don’t skip the paperwork. Ensure the buyer puts down an earnest money deposit (to have skin in the game) and that you have a solid purchase contract. Always verify the proof of funds. This usually means obtaining a bank statement or letter confirming the buyer has enough money in an account to cover the purchase. If a cash buyer can’t promptly show proof of funds, that’s a major red flag. Legitimate cash buyers expect to provide this. Also clarify any contingencies in the contract – some cash offers might still include an inspection contingency or a flexible closing date, for example. Know what you’re agreeing to, even if it’s cash. The sale isn’t done until it’s done, so treating it professionally protects you as the seller.

- Scams or Novelty “Cash” Offers: On rare occasions, you might run into someone claiming to pay cash but actually looking to do something creative (like a delayed purchase, wholesaling your contract to another buyer, etc.). While these situations are uncommon, it’s another reminder to vet the buyer. If the offer sounds too good to be true (like offering full market value in cash with no questions asked, or wanting to do the deal without any standard process), proceed with caution. Use a reputable escrow or title company to handle the closing – that way actual funds must be delivered and verified for the sale to go through. Using professional services (escrow, title, maybe an attorney) in a cash sale will help ensure everything is above board.

In summary, the potential downsides of cash offers are mostly about price and trust. You might sell for a bit less, and you need to make sure you’re dealing with a reputable cash buyer. For many Los Angeles sellers, the speed and certainty outweigh a slightly lower price. But it’s a personal decision – weigh it carefully. If a cash offer is fair and the buyer is trustworthy, it can be a fantastic solution. If not, you can always consider listing your home traditionally or seeking other buyers.

Frequently Asked Questions About Cash Offers

Q: What does a cash offer mean in real estate?

A: A cash offer means the buyer is proposing to buy the property without any financing (no mortgage loan). The buyer has the full purchase price in cash (usually in a bank account) and can pay the seller directly. For the seller, it means a quicker sale with less uncertainty since there’s no waiting on loan approval. Cash offers often appeal to sellers because there’s a lower risk of the deal falling through due to financing issues.

Q: Does a cash offer literally mean the buyer brings cash?

A: Not literally cash in hand – you won’t be getting a briefcase full of dollar bills! In modern real estate transactions, “cash” simply means no financing. The funds are typically transferred via wire transfer or bank check at closing. So an all-cash offer is a bit of a misnomer; it’s not physical cash, but the buyer’s own money (versus the bank’s money). The important part is that no mortgage lender is involved, which streamlines the process.

Q: What is an “as-is” cash offer?

A: An “as is” cash offer means the buyer is agreeing to purchase the home in its current condition, with no repairs or improvements required from the seller. Many cash buyers (especially investors) make as-is offers. This is great for sellers because you won’t be asked to fix anything – what you see is what you get. Even with an as-is offer, the buyer can still do an inspection for their own knowledge, but they typically won’t request repairs. Essentially, an as-is cash offer lets you sell your house for cash without spending time or money getting it market-ready. Just be sure the purchase contract clearly states that the sale is as-is, protecting you from any later repair demands.

Q: How do I know if a cash offer is fair?

A: A reasonable cash offer should be in the ballpark of your home’s market value, minus perhaps a bit for the speed/convenience if it’s an investor offer. To gauge fairness, do some homework: consider getting a comparative market analysis from a Realtor or checking recent sale prices of similar homes in your area. If a cash offer is significantly lower, ask the buyer to explain how they arrived at that price – sometimes they factor in the cost of needed repairs or their desired profit margin if they’re an investor. You can also negotiate. Just because it’s cash doesn’t mean the price isn’t flexible. Some sellers get multiple cash offers to compare. In the end, a fair cash offer is one that meets your needs (debt paid off, enough left to move, etc.) and feels like a win-win. Trust your gut and the data. If it seems too low, you can always counter or decline.

Q: Should I accept a cash offer for my house?

A: It depends on your priorities and circumstances. Accepting a cash offer can be a smart move if you value a quick, certain sale and less hassle. If you’re on a tight timeline or dread the idea of showings and repairs, a cash deal might be ideal. Many sellers in Los Angeles find that a slightly lower cash price is worth the convenience of closing in days and moving on. However, if maximizing price is crucial and you’re not in a rush, you might consider listing on the open market to see if a buyer will pay more (even if they need a loan). It’s also worth considering the buyer’s credibility – accepting a cash offer from a reputable, proven cash buyer (like a well-reviewed company or a known investor) is safer than from an unknown individual with no track record. In short, weigh the pros and cons: speed/certainty vs. price. Often, a cash offer is the right choice for those who need a fast, hassle-free sale. Just make sure the offer is solid and the buyer is the real deal. When in doubt, consult a real estate professional for guidance.

Selling your home for cash can be a great solution in the right situation. It removes much of the stress that comes with a traditional sale. With a cash offer, there are fewer things to worry about – no loan contingencies, no appraisal surprises, and a timeline that can fit your needs. For many Los Angeles homeowners, especially those facing a tight timeline or challenging property issues, an all-cash deal is the easiest and fastest path to the closing table.

Ready to explore a cash offer on your Los Angeles home? Tricia Watts and the MaxNet Homes team have extensive experience in the L.A. market and are here to help. We pride ourselves on a straightforward and empathetic approach, ensuring you get a fair cash offer for your house and a smooth selling process from start to finish. Why not see what a direct cash buyer can do for you? Contact MaxNet Homes today to get a cash offer for your home with zero obligation. We’ll answer any questions you have and guide you through your options.

Don’t let the traditional home-selling process overwhelm you – with the right cash offer, you can sell your house quickly, move on to what’s next, and maximize your net profit with confidence. Get in touch with us now, and take the next step toward a stress-free home sale!