Los Angeles’ Trusted Home Buyer: We Buy Houses For Cash! No Repairs. No Commission.

Sell Your House FAST In Los Angeles, CA

Get a fair cash offer within 24 hours. No repairs. No commissions. No pressure.

We give you more than one way to sell. Pick the option that matches your timeline, goals, and comfort level. Fast close. Flexible close. Or a plan that gives you extra time to move.

“Tricia at MaxNet Homes was there whenever we had a question and even handled our loan payoff so the process stayed smooth.

We followed our gut despite warnings, closed in under two weeks, and got paid the next day. So grateful for a fast, stress‑free sale — thanks Tricia and MaxNet Homes.”

– Audrey⭐⭐⭐⭐⭐

MaxNet Homes is a cash home-buying company that treats our customers right. We know that often times, your house is your largest investment, so we want to make sure you get the MaxNet offer for your home! We buy houses in Los Angeles for cash. We are not here to waste your time or make you a lowball cash offer. We are here to help – not to haggle. When you need to sell your house fast, we will give you our MaxNet Offer every time! You will also be treated with respect because we value your time.

With MaxNet Homes, getting a cash offer for your house is 100% FREE. There are never any obligations. So why not see if we are a good fit before locking yourself into a listing agreement with an agent? You’ve got nothing to lose!

You can see Tricia in action on HGTV’s Flipping 101, Season 2, Episode 7 “ Hope the Buyers Have a Dog” – watch as she transforms a distressed property into a beautiful home.

"We were dealing with some family issues and needed to sell my dad’s house quickly. I reached out to Tricia, and she came by that same day! She was knowledgeable, easy to talk to, transparent, and — most importantly — genuinely cared about our situation. Tricia went above and beyond to make the process easy for my elderly father. She checked in on him regularly to see how he was doing, respected his wishes (including leaving his beloved palm trees untouched), and even accompanied him to escrow because she could tell the process felt intimidating to him. She was able to close on our house under 30 days which helped alleviate a huge headache for my dad. I would highly recommend Tricia with MaxNet Homes!"

Trevor Reverditto

An Honest L.A. Home Buyer

When you need to sell your house fast, it’s important to work with a home buying company that is honest and has a track record of treating people fairly.

Meet Tricia, the founder of MaxNet Homes! Tricia started this company with a simple goal – to streamline the process of selling a home, even under tough conditions. What’s most important to Tricia is that she wants to do right by the people she works with because she knows that selling a house can often be stressful.

Tricia has a tremendous knack for problem solving and takes joy in giving sellers the best service possible when buying their home. A fun fact about Tricia, she was featured in the hit HGTV show Flipping 101 with Tarek El Moussa – Season 2.

Benefits of Selling to MaxNet Homes

Get a Competitive, All-Cash Offer Within 24 Hours

When MaxNet Homes buys your house, it’s our goal to make everything as easy as possible for you. Here are the guarantees that you can expect when we buy your Los Angeles house:

Get A Fast Offer In 24 Hours

Once we have your address, we will get straight to work on running our numbers and can have an offer for your home in 24 hours or less. We don’t even need to see your property to make you an offer, we just need to see some pictures of it! That way it saves you time and the hassle.

No Open Houses

When you sell your house with a realtor you’ll have to do an unlimited amount of open houses and showings, so there’s a lot of pressure to have the house looking perfect at all times. But not with us, we just need to see the house once and we don’t even care if it’s dirty!

Pick Your Closing Day

One of the best parts of selling your house to us is that we can give you the certainty of when you need to close by. So whether you want to close next week or in a few months, we can work around your timeline so that closing day happens when you need it to.

No Commissions

When you sell your house to MaxNet Homes, you’ll save thousands of dollars on real estate commissions because we don’t charge you a cent. Plus, we’ll even go the extra mile and pay for all of the closing costs so that you won’t have to pay any fees when we buy your house.

Sell As-Is with No Repairs

Do you want to forget about all of the repairs your house needs and sell it without having to fix anything or even lift a broom? Selling to us means we buy your house as-is, and will never ask you to fix anything before we buy it. Making the sale completely hassle free!

Company That Buys Houses in Los Angeles, CA

We buy houses as-is in Los Angeles, CA, no matter what condition! That means you don’t need to lift a finger or spend unnecessary cash to sell your house. We buy houses as-is in Los Angeles to fix and then eventually resell them. So we are ready to do the work and have teams to handle big projects. You can leave behind whatever you don’t want, and we’ll handle the grunt work!

Choose The Best Way To Sell A House In Los Angeles

Los Angeles homeowners no longer have to settle for a “one option fits all” model for selling a house or rental property. Whether you have the patience to sell your home for top dollar with one of our experienced real estate agents or you would prefer the speed and convenience of a no-obligation, all-cash offer, MaxNet Homes has you covered. We make selling a home easy!

Our “Quick & Convenient Sale” Option:

Sell your house to MaxNet Homes

Sell without the hassles and stress of a traditional listing with our Cash Offer Program.

Competitive cash offer within 24 hours

Tell us about your property, we’ll evaluate it, and provide you with an obligation-free all-cash offer.

No showings, no hassles

You won’t need to disrupt your life with open houses, weekend showings, and non-stop cleaning.

You choose your closing day

Once you accept our cash offer, you won’t wait 30+ days to close. We close on your preferred date.

We’ll cover any repairs

We’ll handle repairs for you and will even haul off unwanted items at no extra charge.

We pay all closing costs

Closing costs can add up. Our cash offers are all-inclusive, which means there are no hidden fees.

No fees or commissions

By buying your house directly from you, we charge no fees and no commissions.

Our “Sell For Top Dollar” Option:

List your house with MaxNet Homes

The preferred option for homeowners who want to maximize their sale price with a traditional home sale.

Maximize your sale price

We’ll sell your house for the highest possible price with our wide buyer network and the best marketing in Los Angeles.

Peace of mind – no matter what

If a buyer’s financing falls through or your circumstances change and you need to move up your timeline, you have more than one option to sell.

Local expertise & knowledge

From setting the right list price to closing without a hitch, you’ll be supported through every step by our Los Angeles real estate experts.

Our Cash Offer is on standby

When you list with MaxNet Homes, you can activate our local Cash Offer Program at absolutely any time.

How It Works

(Yes, it’s really this easy!)

You could have an all-cash offer within 24 hours and close in as little as 7 days. To start, simply tell us about your Los Angeles area house through our easy information form or give us a call at 1 844-MAXNET-8.

STEP 1

Tell us about your Los Angeles house. We’ll get to work analyzing your property.

STEP 2

We make you a competitive cash offer based on the market value and condition of your home.

STEP 3

Choose the selling option that works best for your unique situation.

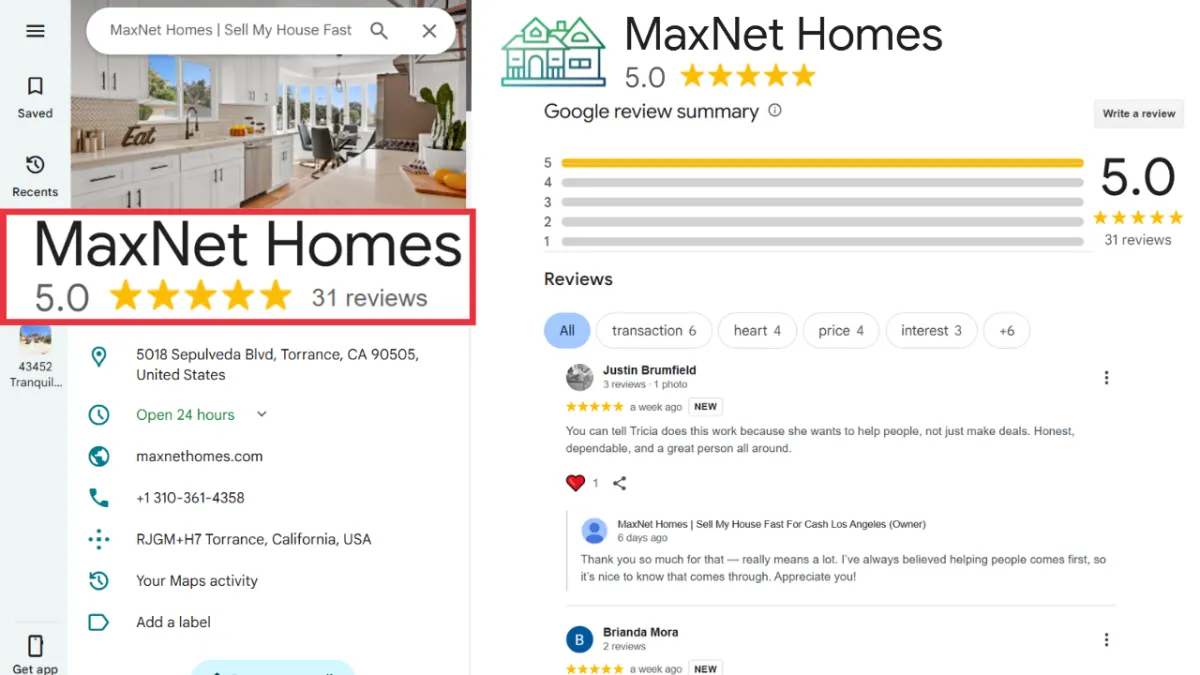

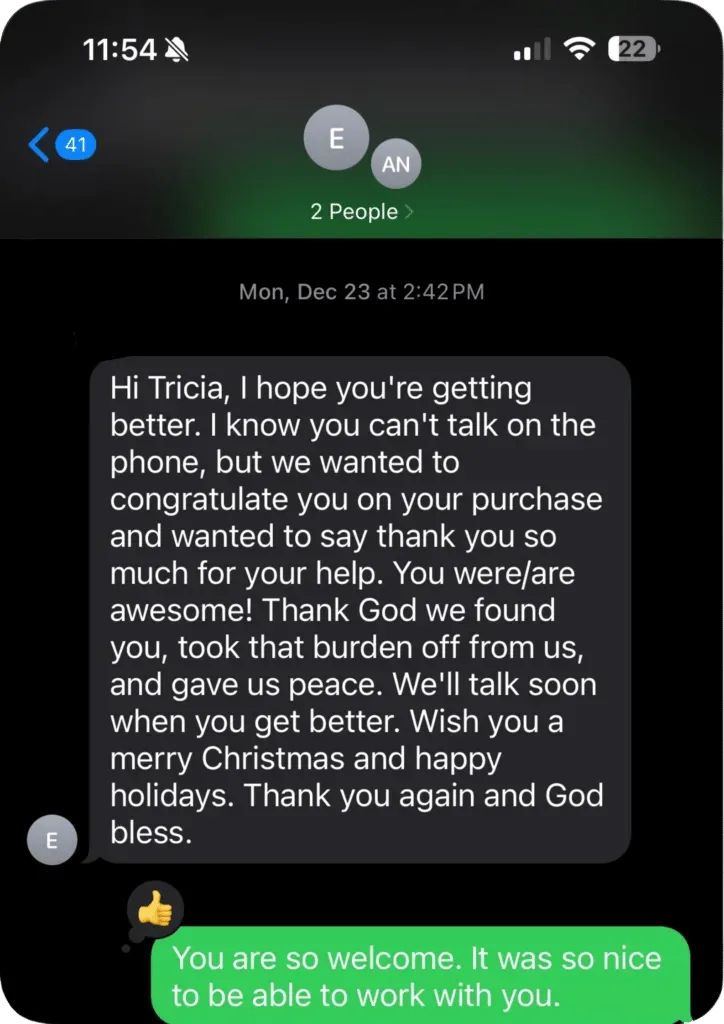

Los Angeles Cash Home Buyer Reviews

See why homeowners across Los Angeles trust MaxNet Homes when they need to sell a house fast for cash.

Our 5-star reviews speak for themselves — real sellers sharing real experiences about smooth, honest, and hassle-free sales.

As one of the most trusted cash home buyers in Los Angeles, we’ve built our reputation on transparency, fair offers, and quick closings.

Before you sell your house to anyone else, take a minute to read what local homeowners are saying about working with MaxNet Homes.

We’re Buying Houses All Over

Southern California

Being professional cash home buyers, MaxNet Homes is the fastest option to sell your house. Don’t own a house in Los Angeles? That’s OK! Dealing in Los Angeles homes is our expertise, and those located in the surrounding cities of Riverside, San Bernardino, San Diego, and Orange County. If you want a fast, hassle-free sale, we’ll make you a competitive cash offer to buy your house. We know the challenges you face when you sell your house and will handle any real estate challenge that comes your way. We promise to treat our Los Angeles customers with kindness and respect. Our service is 100% FREE, and we NEVER charge a commission. Calling us could be the best decision you make today.

Sell My House FAST for Cash in Northern California

How Fast Do You Need To Sell Your House In CA?

As CA‘s trusted investment company, as well as licensed and reputable local real estate agents, MaxNet Homes will help you sell your house the best way for your situation.

Some of the ways we work with Los Angeles homeowners include:

• We will list your house on the MLS using our proven proprietary marketing methods to sell your property for top dollar.

• Or, if you want the speed and convenience of an all-cash sale, we will make you a competitive cash offer and close on the date of your choice.

Give us a call today at 1 844-MAXNET-8 and let us know which option works best for you!

Real Stories, Real Relief

Hear from a happy home seller in Buena Park, CA who had an amazing experience working with MaxNet Homes. From start to finish, our team made the process smooth, professional, and stress-free.

Thinking of selling? Let’s make it easy.

📞 Reach out today for a fast, hassle-free cash offer!

We Buy Houses In Los Angeles In ANY Situation

It doesn’t matter whether you live in it, you’re renting it out, it’s vacant, or not even habitable. We help homeowners in CA stuck in difficult situations. You are not alone! Even if you’ve previously listed the property, the house needs repairs you can’t afford, is fire damaged, or has bad rental tenants, MaxNet Homes wants to work with you to find a solution to whatever issue you might be facing. Read more below:

Expensive Repairs

Did your house suffer major damage in the last storm? Do you want to sell but your kitchen needs upgrades that are too expensive for your pocket book?

Problem Inheritance

Did you inherit a property that’s stuck in probate, has back taxes, or is filled to the rafters with trash?

Divorce

Going through a messy divorce and you need to sell as quickly as possible?

Foreclosure

In default on your mortgage or taxes? Is your house scheduled for auction?

Relocating Out Of State

Need to relocate for work or retirement and want a fast and straightforward sale?

Bad Tenants

Sick of being a landlord with tenants and can’t keep up with property upkeep? Tired of the hassle of finding new tenants?

A Faster and Lower Cost Way To Sell Your Los Angeles House

It doesn’t matter whether you live in it, you’re renting it out, it’s vacant, or not even habitable. We help homeowners in CA stuck in difficult situations. You are not alone! Even if you’ve previously listed the property, the house needs repairs you can’t afford, is fire damaged, or has bad rental tenants, MaxNet Homes wants to work with you to find a solution to whatever issue you might be facing. Read more below:

Avoid open houses and daily showings

No closing costs or commissions

No need to pay for a single upgrade or repair.

Already got an offer? Let us try to beat it!

See what we can offer for your house today.

MaxNet Homes makes selling a house in CA fast, easy, and hassle-free! By offering multiple options to sell that traditional Los Angeles real estate agents and cash home buyers can’t offer, we will help you sell your home on a timeline that works for you. Even if your house needs major repairs, we want to purchase it from you as-is. We buy houses in any condition.

Contact us and submit the short property information form (below). We can give you a competitive cash offer in as little as 24 hours and we can close whenever YOU choose to close, or we can figure out the best way to list and market your property to sell for the highest price possible in your neighborhood.

Best of all, because we don’t have to rely on traditional bank financing if you need the cash quickly we can close in as little as 7 days. (Go here to learn about our process →)

Before You List Your Los Angeles House, Get A Competitive Cash Offer From Us!

No matter what condition your house is in; no matter what situation or timeframe you’re facing…

Our goal is to help make your life easier. We want to get you out from under that house or property in CA that’s stressing you out. With our simple Cash Offer Program, we can pay you a competitive and honest price for your house or guide you through the steps to list your home on the market for top dollar. Either way, we’ve got you covered!

Get Your Fast, Competitive Offer Today!

START HERE: We buy houses in ANY CONDITION. Whether you need to sell your home fast for cash or list with a local agent for top dollar, we can help.

Frequently Asked Questions

How much does a house cost in Los Angeles?

Average price: $850,000

Range: Depends on location, size, and condition

Tip: To sell your Los Angeles house fast, you can skip repairs and list with a cash buyer.

Contact MaxNet Homes today for a fast, fair offer.

How much does a house cost in Los Angeles?

Average price: $850,000

Range: Depends on location, size, and condition

Tip: To sell your Los Angeles house fast, you can skip repairs and list with a cash buyer.

Contact MaxNet Homes today for a fast, fair offer.

How do I find the blueprints for my house in Los Angeles County?

Check with Los Angeles County Department of Public Works

Visit your local city’s building and safety office

Ask previous owners or builders if available

No blueprints? No problem — sell your Los Angeles house fast with MaxNet Homes.

Contact MaxNet Homes for a quick cash offer today.

How much is the one house in Los Angeles?

Original list price: $295 million

Final sale price: Around $141 million (2022)

Location: Bel-Air, Los Angeles

Want to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick and fair cash offer today.

How do I find out who owns a house in Los Angeles?

Search Los Angeles County Assessor’s website

Request records from the County Registrar-Recorder’s office

Hire a title company for detailed reports

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

How do I find out who owns a house in Los Angeles?

Search the Los Angeles County Assessor’s website

Request records from the Registrar-Recorder’s office

Hire a title company for deeper research

Looking to sell your Los Angeles house fast?

Contact MaxNet Homes for a fast cash offer today.

How much do I need to live comfortably in LA?

Estimated income: $75,000 to $100,000 per year

Factors: Rent, transportation, food, healthcare

Housing costs heavily impact your budget

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

Is it cheaper to buy or build a house in Los Angeles?

Buying is usually cheaper than building

Land, labor, and materials drive up construction costs

Existing homes offer quicker move-in options

Looking to sell your Los Angeles house fast?

Contact MaxNet Homes for a fair cash offer today.

How long does it take to get a building permit in Los Angeles?

Small projects: 2–4 weeks

Large or complex projects: Several months

Factors: Plan check, approvals, zoning reviews

Looking to sell your Los Angeles house fast without the hassle?

Contact MaxNet Homes for a quick cash offer today.

Are LA property records public?

Yes, they are public

Search through the Los Angeles County Registrar-Recorder’s office

Some records are available online for free

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

The Best Way To Sell Your House Quickly

Stuck in foreclosure? Facing a messy divorce? Liens against the title? Probate? MaxNet Homes helps property owners all over Los Angeles and other parts of CA sell their homes fast.

There’s no issue we haven’t dealt with! We’ve helped homeowners who own vacant property, have a house about to go to auction, are stuck with a hoarder inheritance, retiring and want to downsize, and more. Call us today and let’s work together to find a solution to whatever situation you might be facing.

We buy houses in CA, including Los Angeles and the surrounding area, for a competitive cash price on a schedule that works for you. Since we also operate as traditional real estate agents, our knowledge and experience of the local market means that we can help you get top dollar for your house through a traditional home sale. If you’re looking to maximize the amount you can get for your house, we will partner with you to list your Los Angeles, CA house to sell it for top dollar.

To start, let us know about the property you’re ready to see in your rearview mirror. Let us know if you would like to sell that unwanted house or rental property for a competitive cash price fast or work with us to get the most money possible with a traditional home sale.

We buy houses in Los Angeles and all surrounding areas in CA. If you need to sell your house fast, connect with us today. We would love to make you a no-obligation cash offer that is hassle-free. 🙂

Call us today at 1 844-MAXNET-8