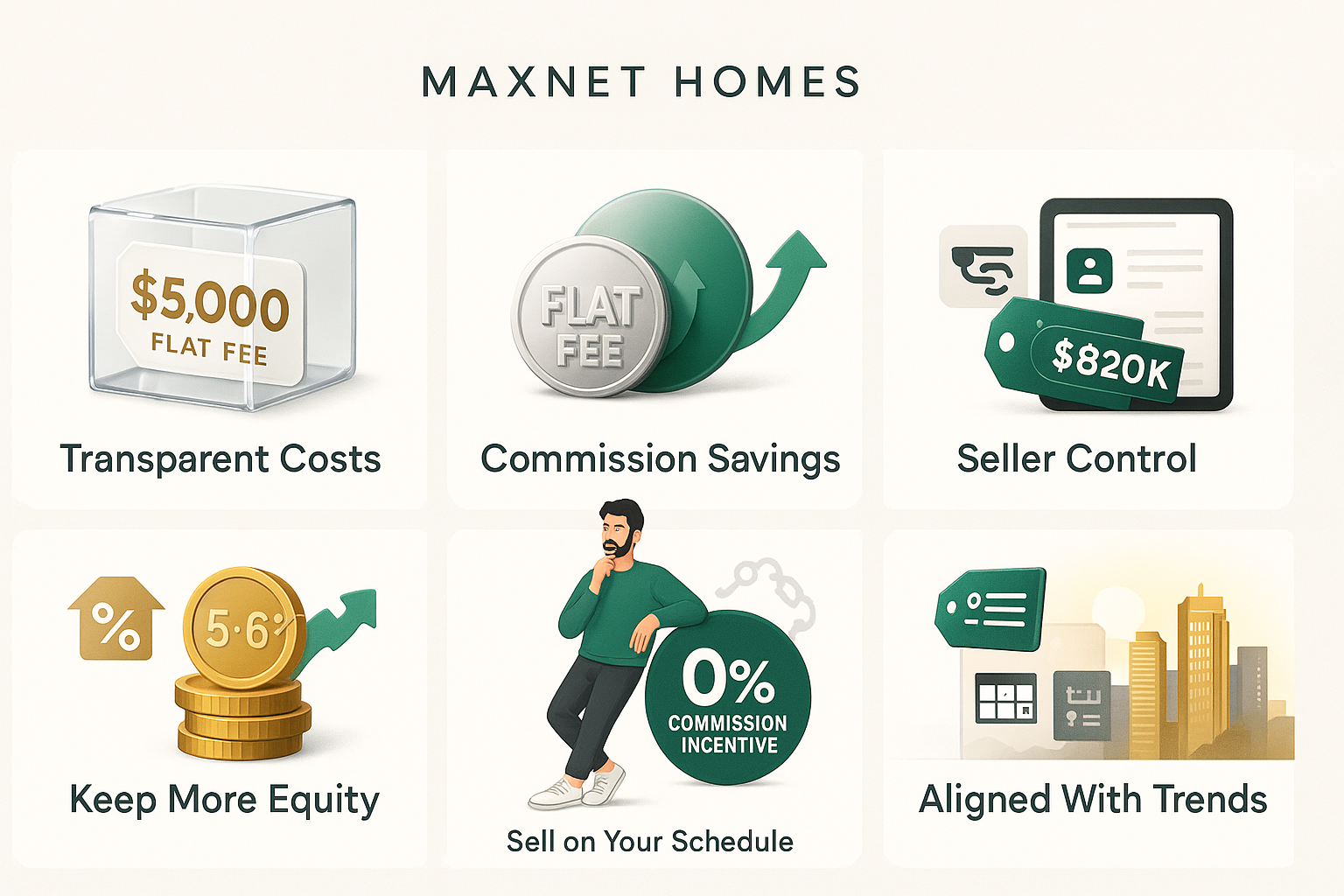

Selling your home in Los Angeles can feel overwhelming – especially when you realize a traditional real estate agent might charge 5-6% of your sale price in commissions. On a $800,000 L.A. home, that’s $40,000–$48,000 out of your pocket! It’s no surprise that many homeowners start searching for ways to save money on realtor fees. You may have even seen ads to “sell your home for a flat fee” or encountered terms like flat fee real estate agent, fixed rate realtor, or low cost real estate broker. The promise is simple: instead of paying a hefty percentage-based commission, you pay one flat fee (say $5,000) to list and sell your home, no matter the price.

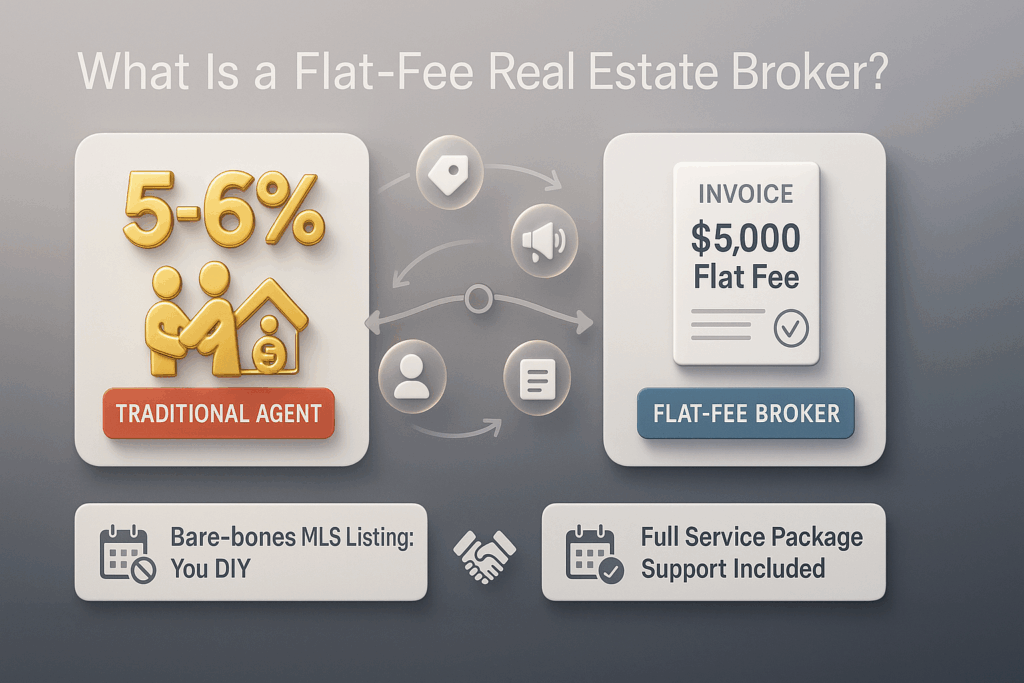

But are flat fee realtors a good idea? Will a flat fee broker truly maximize your net proceeds, or could it cost you in other ways? In this guide, we’ll break down what flat fee real estate brokers are, the pros and cons of using one, and what it means for Los Angeles homeowners. We’ll also explore alternatives – including a smarter option to save money and reduce hassle. By the end, you’ll understand your options and be better equipped to decide the best way to sell your home while keeping more of your money.

What Is a Flat Fee Real Estate Broker (and How Do They Work)?

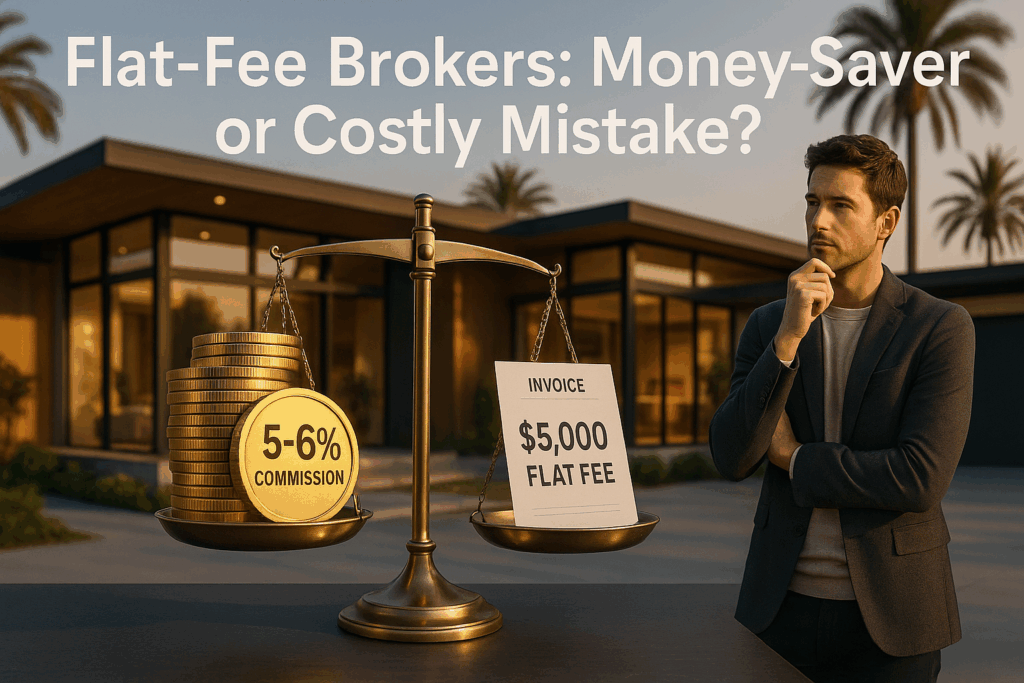

A flat fee real estate broker (or flat fee Realtor) is a licensed real estate agent or brokerage that charges a fixed price for their listing services instead of a percentage of your home’s sale price. In a traditional home sale, the standard commission is around 5%–6% of the sale price (often split between the listing agent and buyer’s agent). With a flat fee arrangement, you might pay, for example, $5,000 flat to your listing agent regardless of your home’s price. In California’s high-priced market, this fixed-fee model can sound very appealing – paying $5,000 instead of ~$25,000 (3% of an $800k home) in listing commission is a huge difference.

What does that flat fee cover? Typically, it covers the basics of getting your home listed for sale. This usually includes putting your home on the Multiple Listing Service (MLS) (so it appears on sites like Zillow and Realtor.com), and may include some marketing and coordination of your transaction. Essentially, flat fee means you’re paying for a specific set of services upfront. It’s often considered a “fee-for-service real estate” model. You know exactly what you’ll pay for the agent’s service, giving you a predictable cost to budget for.

However, it’s crucial to read the fine print. Some so-called flat fee brokerages advertise a low fee but then charge additional percentages or fees based on the sale. For example, a company might charge $3,000 up front but add a 1% commission if your home sells, or higher flat fees for luxury properties. Always clarify exactly what’s included in the flat fee and whether any other fees apply.

Flat Fee vs. Flat Fee MLS Listing: Don’t confuse a full-service flat fee broker with a flat fee MLS listing service. A flat fee MLS service is usually a bare-bones package (often just a few hundred dollars) where the company will list your home on the MLS for a flat fee, but won’t provide full agent services. Essentially, you’re acting as the seller-agent after they list it – managing inquiries, showings, negotiations, and paperwork on your own. This is a popular route for experienced For Sale By Owner (FSBO) sellers who just need MLS exposure. The pros and cons of a flat fee MLS listing are a bit different: you’ll save more money because the fee is very low, but you truly get limited service (just the MLS listing and maybe a sign). A flat fee real estate broker, on the other hand, is typically a licensed agent/team offering a **fixed-price package that may include more services (pricing assistance, some marketing, offer negotiation help, closing coordination, etc.). Think of it this way: a flat fee MLS listing is usually “MLS-only, you’re on your own,” while a flat fee broker/agent offers **discounted **service – some support for a set fee.

Now that we know what flat fee brokers are, let’s dive into the potential advantages and disadvantages of using one when selling your home in Los Angeles.

Pros of Using a Flat Fee Real Estate Broker

For many home sellers, the main appeal of flat fee brokers is saving money. But there are other potential benefits as well. Here are some key pros of flat fee real estate services:

- Transparent, Upfront Costs – No Surprises: With a flat fee agent, you know from day one exactly what you’ll pay to list your home. Whether your house sells for $500,000 or $5,000,000, the listing fee is the same fixed amount. This makes it easy to budget for your selling costs and calculate your expected profit. There’s no complicated percentage to compute and no worrying that an agent might push for a lower sale price just to secure a commission. The financial aspect is straightforward and transparent. (In fact, many clients find this simplicity refreshing – no need to negotiate commissions or wonder if you’re overpaying an agent.)

- Potential Commission Savings: If your flat fee truly ends up lower than a typical commission, you keep more of your home’s equity. For example, if you pay a $5,000 flat fee instead of a 2.5% listing commission on a $800,000 home, you’d save about $15,000. That’s money that stays in your pocket as part of your net proceeds. For budget-conscious sellers or those with lower equity, these savings can make a big difference. It’s one of the main reasons flat fee home selling has gained popularity, especially in high-price areas like CA.

- No Pressure of Percentage-Based Incentives: Because a flat fee broker’s compensation isn’t tied to the sale price, you might worry less about conflicts of interest. A traditional agent paid on commission might be tempted to sell quickly (even at a lower price) or conversely hold out for a slightly higher price – either way, their paycheck is on the line. In theory, a flat fee agent is focused on providing good service to keep you satisfied, since they’ve already set their fee. They don’t gain extra by urging you to accept a lower offer or pushing for a higher one; the market will set the price. This can create a sense that the agent is “on your side” rather than “chasing a commission.” The experience may feel more consultative and less sales-driven, which many sellers appreciate.

- More Control for Experienced Sellers: Flat fee arrangements often appeal to those who want a more hands-on role in their sale. Because some flat fee packages are limited service, you as the homeowner might end up handling parts of the process (like scheduling showings, hosting open houses, or negotiating with buyers). If you’re a seasoned seller or someone who prefers control, this can actually be a pro. You’re not tied to an agent’s schedule for showings, and you can make key decisions directly. Essentially, you get fee-for-service help with the MLS and maybe advice, but you maintain ownership of the process. For confident sellers who have sold homes before (or who enjoy the DIY aspect), a flat fee broker can be a way to get the home listed on MLS and guidance on paperwork without surrendering complete control to an agent. You’re paying for exactly what you need, and no more.

- Market-Driven Pricing: In a flat fee scenario, the market truly determines your home’s sale price. A commission-based agent might be tempted to underprice a home for a quicker sale (to secure a commission sooner) or even overprice it (to potentially get a bigger commission if it sells high). Since a flat fee agent’s pay doesn’t change with price, they have less incentive to fiddle with pricing for their benefit. Ideally, they’ll help you price appropriately, but ultimately the price is what buyers are willing to pay. Sellers sometimes feel this approach results in a fair market value sale without any influence from an agent’s commission motives. In hot markets (like many Los Angeles neighborhoods in a seller’s market), a well-priced home can practically sell itself – a flat fee agent simply facilitates the listing.

In summary, the main advantages of flat fee real estate brokers are cost savings, predictability, and control. You know what you’ll pay upfront, you could save thousands in fees, and you aren’t dealing with an agent who’s fixated on a commission. For the right kind of seller and situation, these benefits are very attractive. However, it’s not all upside – there are significant trade-offs to be aware of before you decide to go the flat fee route.

Cons of Using a Flat Fee Real Estate Broker

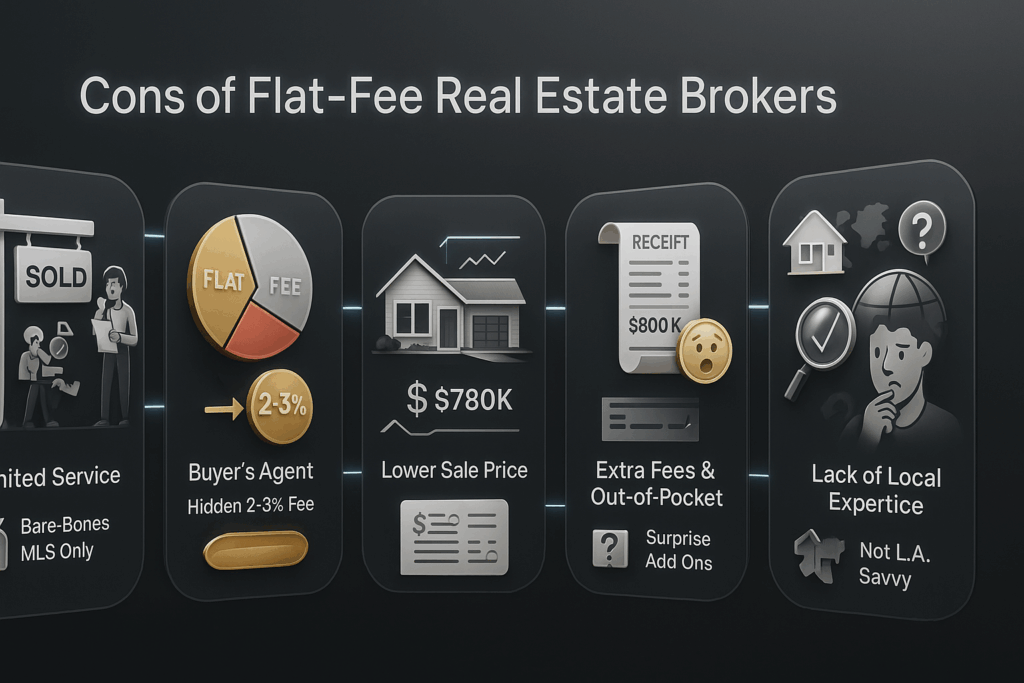

While saving on commission is great, flat fee brokerage services come with potential drawbacks. It’s important to weigh these cons against the pros, especially for Los Angeles homeowners who want top-dollar in a competitive market. Here are the major disadvantages of flat fee real estate brokers:

- Limited Service (You Might Be On Your Own): The saying “you get what you pay for” often applies here. To keep costs low, flat fee brokers tend to offer limited or basic services. This could mean they only list your home on MLS and provide standard forms, but won’t include extras like professional photography, staging advice, extensive marketing, or hosting open houses. Many flat fee agents handle far more clients at once (because they make less per sale), so you may get less personalized attention. If you want hand-holding or a full-service experience, a flat fee agent could disappoint you. In some cases, essential tasks fall to the seller: you might have to answer buyer inquiries, coordinate showings around your schedule, and even negotiate directly with buyers or their agents. Tricia Watts – a Los Angeles real estate expert and founder of MaxNet Homes – notes that some flat fee packages “basically put your home on MLS and then it’s up to you to do the rest.” This limited-service real estate agent model works fine for confident sellers, but it can be overwhelming for first-timers or those who don’t have the time and expertise to manage a sale. Before you commit to a flat fee listing, make sure you understand which services are included and which you’ll have to handle (or pay extra for). Otherwise, you could end up with unexpected work and expenses, undermining the very savings you hoped to achieve.

- You Still Pay the Buyer’s Agent (So Savings May Shrink): A flat fee broker typically helps you save on the listing agent commission – but what about the buyer’s agent? In a normal sale, the seller usually offers 2%–3% commission to any agent who brings a buyer. Using a flat fee listing doesn’t get you off the hook for that (unless you find a buyer who has no agent, which is less common in Los Angeles). To attract buyers’ agents, you’ll likely need to offer a competitive commission. That means while you might pay your listing agent only $3k–$5k flat, you could still owe another ~$15k (3% of sale price) to the buyer’s representative at closing. Some sellers try to avoid offering a buyer’s agent commission to save even more – but this strategy can backfire big time. Most buyer’s agents will be reluctant to show a home that isn’t offering them any compensation. In effect, your listing might get less visibility or interest, which could delay your sale or force you to accept a lower price. So, in many cases, the total commission savings with a flat fee broker aren’t as huge as they appear. You might end up paying that 2-3% on the buyer’s side regardless, which, combined with the flat fee, could bring your total costs closer to a traditional commission split. Always do the math: a flat fee service could save you money, but only if you account for all other costs too.

- Possibly Lower Sale Price (Less Incentive to Maximize Value): A traditional agent’s motivation is to get you the highest price – both because it benefits you and it increases their commission. With a flat fee agent, that extra incentive isn’t there. Some flat fee brokerages operate on a volume business model: they make money by handling many listings and closing them as fast as possible, rather than spending extra time to squeeze every last dollar out of each sale. This means a flat fee agent might be less aggressive in marketing and negotiation, potentially resulting in a lower sale price. They want to sell your home quickly (to move on to the next client), whereas a full-service agent might fight for a higher price or better terms. In a market like Los Angeles, where nuances in marketing and negotiation can add tens of thousands to your sale, this is a serious consideration. If maximum profit is your priority, a flat fee agent’s one-size-fits-all approach could be a costly mistake. You risk not getting top dollar for your property. (Think of a flat fee listing agent as a “transaction facilitator” vs. a dedicated advocate for your price.)

- Extra Fees and Out-of-Pocket Costs: Remember that attractive flat fee you’re paying? It usually covers only a basic scope of work. If you realize you need additional help, you may have to buy add-on services. For instance, professional photography, lockbox and yard sign, premium online ads, or even assistance with paperwork might come at an extra charge. Some flat fee brokerages have tiered packages – the lowest tier might just list the home, while higher tiers (costing more) include things like agent support with negotiations or a limited number of in-person meetings. Unexpected expenses can also crop up if your home doesn’t sell quickly. Traditional agents often absorb marketing costs until closing, but with a flat fee service, you pay upfront regardless of outcome. If your home sits on the market, you might feel pressure to pay for upgrades like better photos, staging, or buyer incentives out of pocket, since the flat fee agent has little skin in the game after listing. Additionally, flat fee brokers require their fee whether or not your home sells. If for some reason your property doesn’t sell or you decide to cancel the listing, that money is gone. In short, the flat fee commission real estate model can shift more financial risk to you as the seller.

- Legal and Transaction Risks (Less Guidance): Selling a home involves a lot of paperwork and legal requirements – from disclosure forms to escrow timelines. With a full-service agent, you have someone guiding you through these minefields, ensuring everything is filled out correctly and protecting you from liability. Many flat fee brokers provide only minimal guidance here. For example, you might be left to handle all the seller’s disclosures on your own. Mistakes in paperwork can lead to legal consequences (especially in California, where disclosure laws are strict). An error or omission could come back to bite you after the sale. If your flat fee service doesn’t include consulting with you on contracts or overseeing the closing process, you’re essentially acting without a safety net. Some flat fee companies will offer additional help or broker consultation for another fee, but at that point your costs are rising closer to a traditional agent model. Tricia Watts emphasizes that experienced professional oversight is vital in complex transactions: “Real estate regulations and contracts can be confusing. If you’re not getting full guidance from your agent, you could be exposed to costly mistakes.” This is not to say flat fee agents are unprofessional – many are great licensed brokers – but by design their limited involvement means less protection and support for you. If you’re not 100% confident in the process, this is a serious downside.

- Potential Lack of Local Expertise: Real estate is local. Markets differ by city, neighborhood, even block by block – especially in diverse areas across Los Angeles. Some flat fee brokerages (particularly national or online ones) might not be deeply familiar with your local market. They could be based out of a different city or assign you a rotating cast of assistants. Without local expertise, you might get subpar pricing guidance or marketing that misses the mark for L.A. buyers. A traditional local agent intimately knows which neighborhoods are hot, what features Los Angeles buyers covet, and how to position your home to get the best offers. A flat fee service that treats it like just another listing on a spreadsheet might not capture those nuances. This could hurt your final outcome, either in price or days on market. When considering any flat fee real estate brokers near me, make sure they truly understand the Los Angeles area and California regulations. If not, the low fee isn’t worth the potential missteps.

As you can see, many of the cons boil down to flat fee brokers offering limited service and limited incentive. You might save money on fees, but you could end up with more work, more risk, and possibly less profit from your sale. It really comes down to your comfort level and your specific situation. Next, let’s talk about when a flat fee Realtor makes sense – and when it might not – as well as some alternatives to consider.

Is a Flat Fee Realtor Right for You?

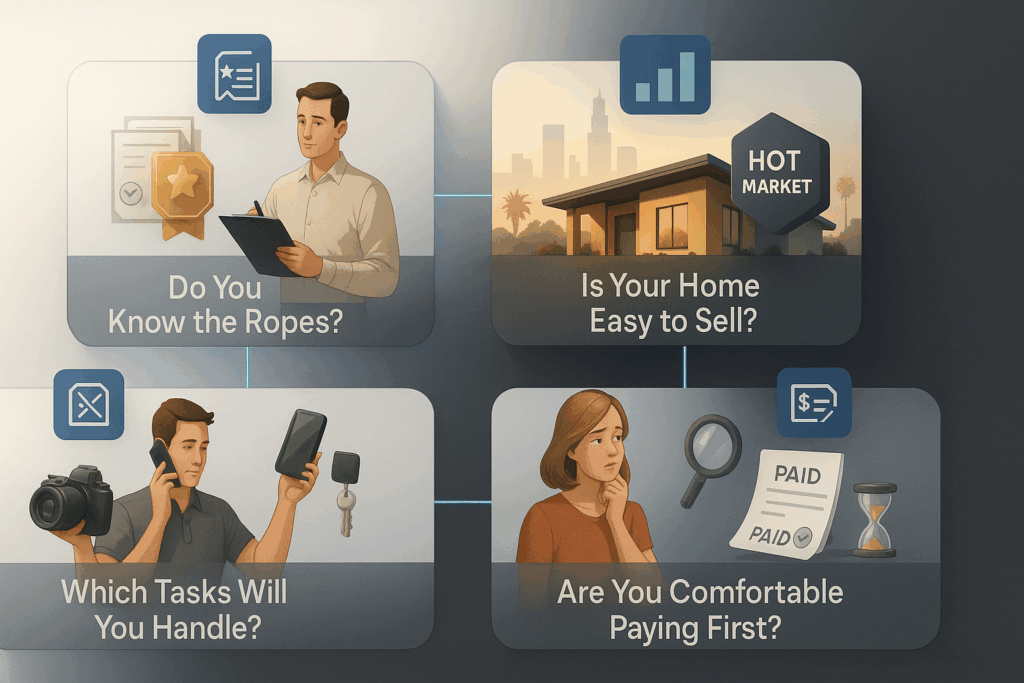

Flat fee real estate services aren’t one-size-fits-all. They work great for some sellers and not so well for others. How do you know if using a flat fee Realtor is a smart move for your situation? Ask yourself a few key questions:

- How much experience do you have with home sales? If you’ve bought and sold multiple properties and feel comfortable handling negotiations and paperwork, you might do well with a limited-service flat fee arrangement. Experienced homeowners who “know the ropes” can leverage a flat fee broker to handle the MLS listing while they confidently manage the rest. On the other hand, if this is your first time selling a home, or it’s been many years, you might prefer the guidance of a full-service agent. Flat fee deals put more responsibility on you, so be honest about your knowledge and comfort level.

- Is your property “easy” to sell? Consider the home itself and the market conditions. In a strong seller’s market (where buyer demand is high and homes move quickly) – which is often the case in desirable Los Angeles neighborhoods – a flat fee listing can be sufficient to get the home sold because demand does a lot of the work. Similarly, if your house is in great condition, in a popular area, and priced attractively, it may practically sell itself with minimal marketing. In these scenarios, paying less commission makes sense because you didn’t need an agent to work overtime to find a buyer. Alternatively, if your property is unique, higher-end, or might require targeted marketing (for example, a luxury home in Beverly Hills or a fixer-upper that needs the right buyer), a full-service approach might yield a better outcome. Complex sales (homes that need staging, have legal complexities, or a limited buyer pool) usually benefit from an agent’s expertise and network.

- What services will you truly need? Make a realistic list of what tasks you can handle and which you’d struggle with. Can you take quality photos, write an enticing listing description, and field calls from buyers? Are you comfortable hosting open houses on weekends or showing the home on weeknights? Will you be able to confidently review offers and navigate escrow paperwork? If the answer is yes to most of these, you could be a good candidate for a flat fee broker (who essentially does the listing paperwork and leaves the rest to you). If the answer is no – you either don’t have the time or the know-how for these tasks – then paying a bit more for an agent who handles these services is probably worth it. Remember, your stress and time have value too. Sometimes sellers underestimate the workload of selling a home.

- Are you okay with paying upfront, regardless of outcome? Most flat fee arrangements require you to pay the fee upfront or at listing time, not at closing. If your home doesn’t sell, that money is spent. Traditional agents only get paid if and when your home sells successfully – that’s a built-in protection for you. With a flat fee, you carry more risk. If you’re confident in your home’s marketability or you’re okay with that risk for the chance to save money, fine. But if you need that sale to happen to justify the cost, think carefully.

In short, a flat fee Realtor can be ideal for a confident, hands-on seller with a straightforward sale in a strong market. It can fall flat (no pun intended) for someone who needs guidance, has a challenging sale, or simply doesn’t have the bandwidth to manage a lot of the work. There’s no shame in either path – it’s about what’s best for your situation.

Alternatives to Flat Fee Brokerages (Maximizing Value and Saving Money)

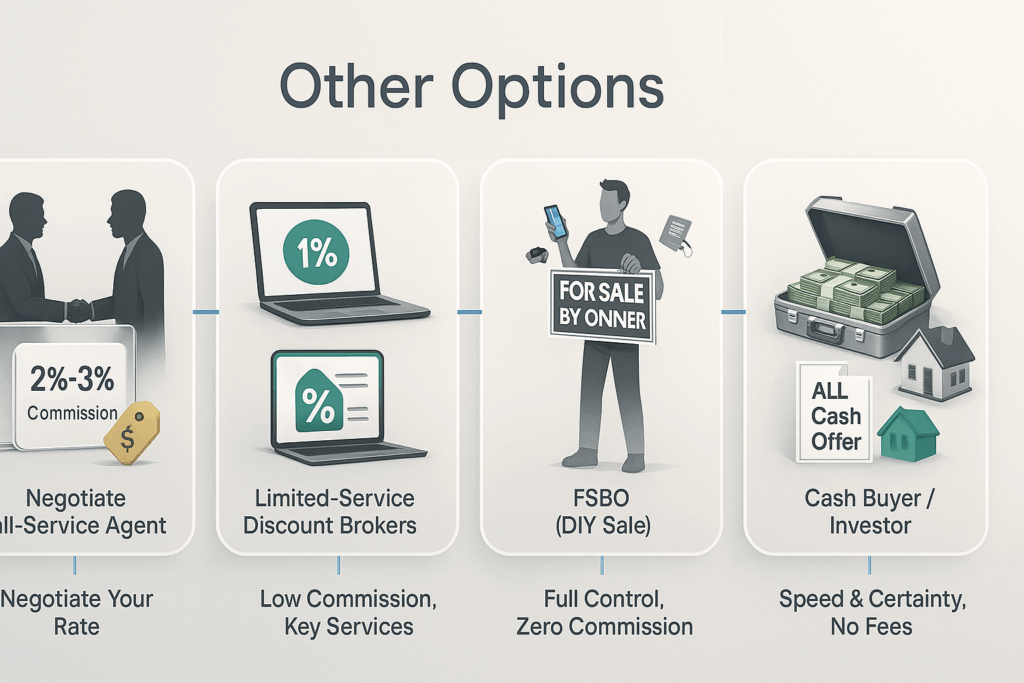

Flat fee brokers are just one way to save on commission costs. Los Angeles homeowners have a few other options to consider if you’re exploring alternatives to the traditional 5-6% agent commission:

- Negotiate a Lower Commission with a Full-Service Agent: Traditional agents want your listing, especially in a hot market like Southern California. Many are willing to negotiate their commission. For instance, instead of 3% for listing, a broker might agree to 2% or a fixed listing fee if your home is likely to sell quickly or if you’re also buying a home with that agent (double business for them). Some top agents offer a “discount” or sliding scale for higher-priced properties. By interviewing a few agents, you might find a full-service realtor who’s flexible on fees – giving you the best of both worlds: professional service and some savings. The key is to ask upfront. You may be pleasantly surprised that even a traditional agent can work out a deal that approaches a “flat fee” style arrangement, especially if your home will be an easy sale.

- “Limited Service” or Low-Commission Agents: Beyond flat fee vs. full commission, there’s a middle ground: agents who charge a smaller commission percentage (say 1% or 1.5% for listing) or offer limited services for a lower fee. Sometimes called low cost real estate brokerages or discount realtors, these are firms that streamline their operations to charge less. They might still handle the key parts of the sale but may expect you to do some tasks (or they operate with a higher volume of clients). Always vet the details of their service offerings. Some discount brokerages in California provide excellent full service at a lower cost – they’re able to do this through efficiency or by taking on more clients. Others might cut corners. Read reviews and ask exactly what’s included, just as you would with a flat fee service.

- For Sale By Owner (FSBO) – DIY Selling: This is the no-agent route. You do everything yourself – marketing, pricing, negotiations, paperwork. Your only costs might be small ones like paying for an MLS listing service (flat fee MLS entry), some advertising, and an attorney or transaction coordinator to handle the closing documents. FSBO means no listing agent commission at all. If you also find a buyer on your own who isn’t represented, you could avoid the buyer’s agent commission too – making it a “no commission” sale (truly a no fee real estate scenario). The obvious benefit is maximum savings. The drawback is the enormous time and effort required, and the risk of mistakes or getting a lower price due to limited exposure. FSBO can work for those who already have a buyer lined up or have deep real estate knowledge. Statistics show, however, that many FSBO sellers eventually hire an agent or flat fee service after struggling to generate interest. So approach this with caution and lots of research. It’s an option to consider if you’re very confident and resourceful.

- Sell to a Cash Buyer or Investor: If your priority is a quick, hassle-free sale and zero agent fees, selling directly to a cash buyer can be an excellent alternative. Companies like MaxNet Homes (right here in Los Angeles) will buy your house directly for cash, without any commissions or listing process. With a direct cash sale, you don’t pay a listing fee or a buyer’s agent – there are no real estate agents involved, period (hence sometimes called a no fee realtor solution). You also skip repairs, open houses, and lengthy buyer loan approvals. The sale can close in as little as a week or on your timeline. The trade-off is that cash offers are typically below full market value (the investor needs some margin to resell or rent out the home). However, when you factor in the money saved on commissions, closing costs, and holding costs (like extra mortgage payments, taxes, etc. while you wait for a buyer), many sellers find that the net profit is comparable. Plus, it’s done with far less stress. MaxNet Homes, for example, is a local family-owned company (founded by Tricia Watts, who has even been featured on HGTV’s Flipping 101) that prides itself on transparency and fair offers. They provide competitive cash offers for houses in the Los Angeles area and charge no fees whatsoever – meaning what they offer you is what you walk away with at closing. For homeowners who have found that a flat fee listing still didn’t meet their needs (or those who simply value convenience and certainty), a direct sale to a reputable cash buyer can be a smart alternative to flat fee brokerages. Essentially, you’re paying nothing in fees and getting peace of mind with a guaranteed sale. It’s worth considering if the priority is a swift, certain sale, or if your property needs work that you’d rather not deal with. Just be sure to work with a trusted, local company that won’t give you a lowball offer. (Tip: Always check testimonials and ensure they have a good reputation for fair deals.)

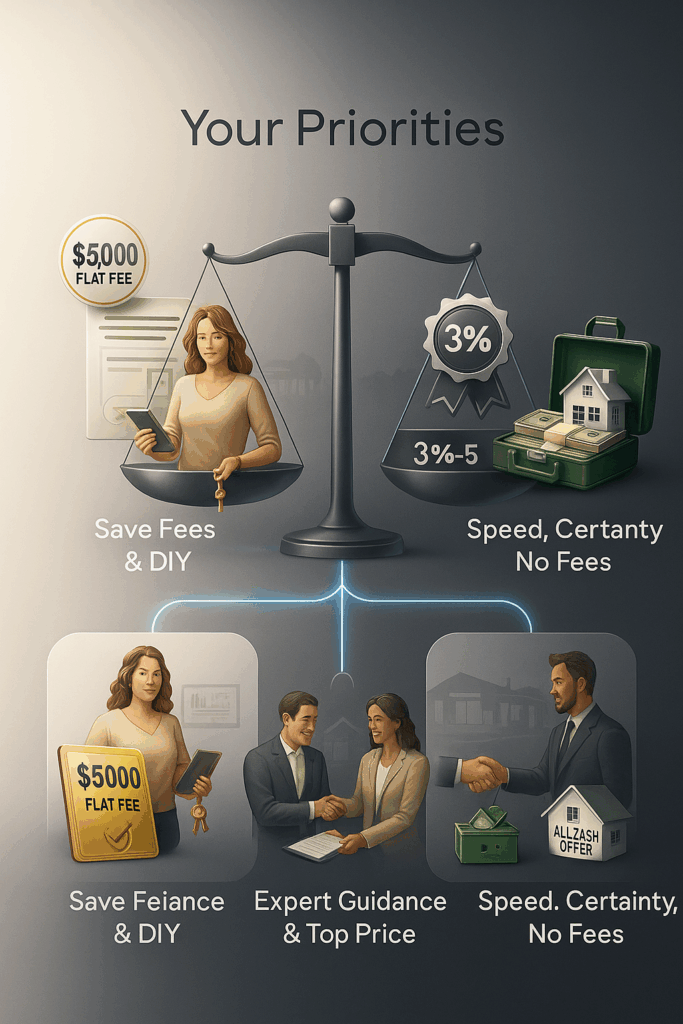

Making Your Decision: What’s the Best Way to Sell Your Los Angeles Home?

Choosing how to sell your home comes down to your priorities and circumstances. If saving every possible dollar in fees is your top priority and you’re equipped to handle some duties yourself, a flat fee real estate agent could be a great fit. Just go in with eyes open about what’s included, and be prepared to take on more responsibility. On the other hand, if you value a full-service experience or need expert guidance, then paying a bit more in commission might actually make you more money in the end – by ensuring a smoother process and a higher sale price. And if you absolutely want to avoid commissions and hassles, exploring a direct cash sale could be your best move.

As a Los Angeles homeowner, you have options. The real estate landscape here is dynamic, and whether you choose a traditional agent, a flat fee broker, or an alternative like MaxNet Homes, the goal is the same: maximize your net profit (your bottom line) while minimizing stress.

Bottom line: Flat fee brokers offer a compelling promise of savings, but be sure the savings are worth what you might be giving up in service and results. Consider speaking with a few different types of agencies. You might even mix strategies – for example, try a flat fee listing for a couple of months, and if it doesn’t sell, then pivot to a full-service agent or a cash buyer.

Ready to Take the Next Step?

If you’re thinking about selling your home in the Los Angeles area, it pays to have an expert on your side. MaxNet Homes is here to help you evaluate all your options. We’re not just investors – we’re real estate professionals who care about your goals. Reach out to Tricia Watts and the MaxNet Homes team for a no-obligation consultation. We’ll gladly discuss how you can sell your home – whether through a traditional listing, a flat fee approach, or a direct cash sale – and help you figure out what makes the most sense for you. Our mission is to help you maximize your net profit and make the home-selling process straightforward and stress-free.

🏠 Ready to explore your best option? Contact MaxNet Homes today to learn how we can help you sell your Los Angeles house on your terms – and always for the maximum net in your pocket. Let’s turn your home-selling experience into a success story! Call us or send us a message to get started and take the next step toward a smarter, cheaper, and easier home sale.